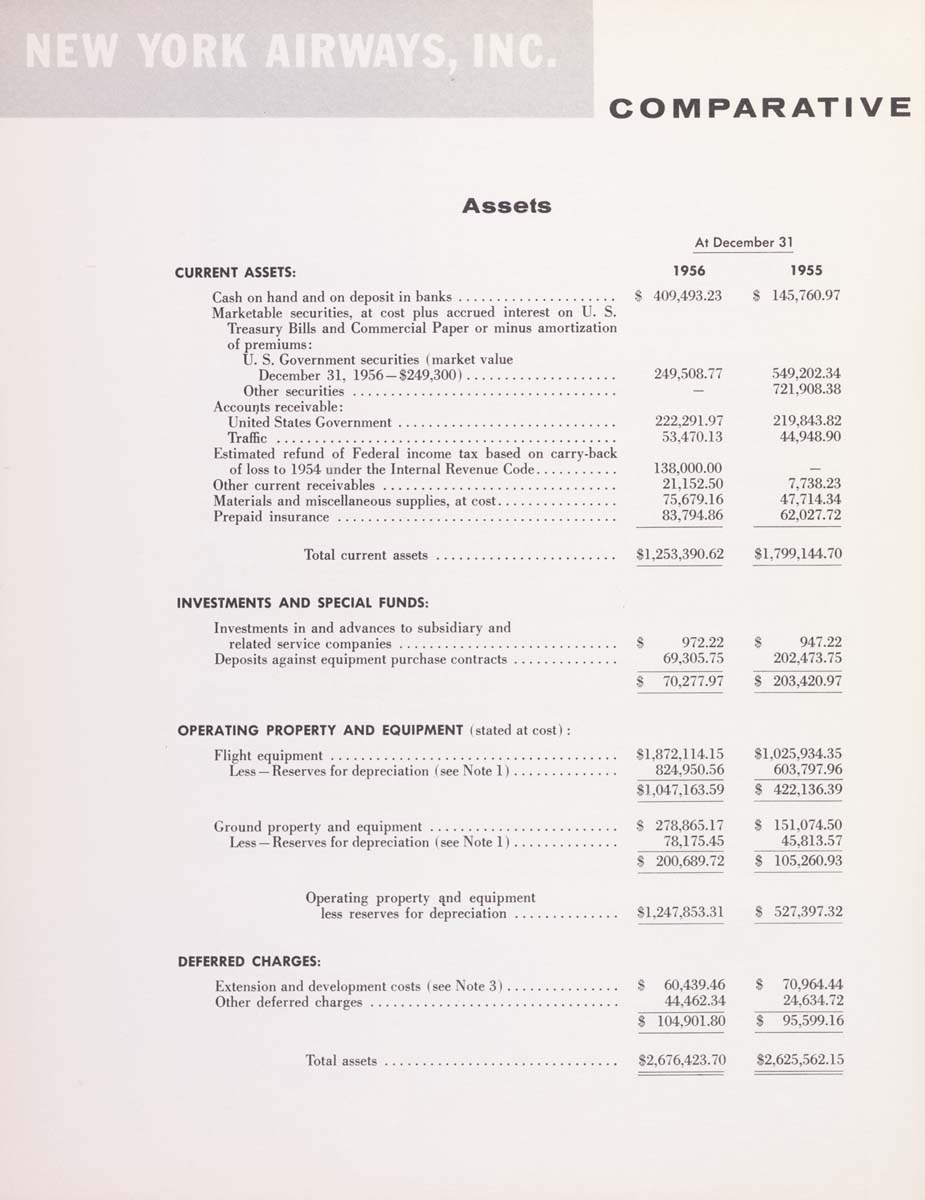

COMPARATIVE

Assets

At December 31

CURRENT ASSETS: 1956 1955

Cash on hand and on deposit In banks..................... .S 409,493.23 » 145,760.97

Marketable securities, at cost plus accrued interest on U. S.

Treasury Bills and Commercial Paper or minus amortization

of premiums:

U. S. Government securities (market value

December 31, 1956-$249,300).................... 249,508.77 .549,202.34

Other securities ................................... - 721,908.38

Accounts receivable:

United States Government............................. 222,291.97 219,843.82

Traffic ............................................. .53.470.13 44,948.90

Estimated refund of Federal income tax based on carry-back

of loss to 1954 under the Internal Revenue Code........... 138,000.00 —

Other current receivables............................... 21,1,52.50 7,738.23

Materials and miscellaneous supplies, at cost................ 75,679.16 47,714.34

Prepaid insurance ..................................... 83,794.86 62,027.72

Total current assets ........................ $1,253,390.62 81,799,144.70

INVESTMENTS AND SPECIAL FUNDS:

Investments in and advances to subsidiary and

related service companies............................. S 972.22 S 947.22

Deposits against equipment purchase contracts.............. 69,,305.75 202,473.75

i 70,277.97 $ 203,420.97

OPERATING PROPERTY AND EQUIPMENT (stated at cost) :

Flight equipment...................................... $1,872,114.15 $1,025,934.35

Less — Reserves for depreciation I see Note 1).............. 824.950.56 603,797.96

$1,047,163.59 $ 422,136.39

Ground property and equipment......................... $ 278,865.17 $ 151,074.50

Less — Reserves for depreciation I see Note 1 (.............. 78,175.45 45,813.57

$ 200,689.72 $ 105,260.93

Operating property qnd equipment

less reserves for depreciation.............. $1,247,853.31 S 527,397.32

DEFERRED CHARGES:

Extension and development costs (see Note 3)............... S 60,439.46 $ 70,964.44

Other deferred charges................................. 44,462.34 24,634.72

$ 104,901.80 $ 95,599.16

Total assets............................... $2,676,423.70 $2,625,562.15

|