13

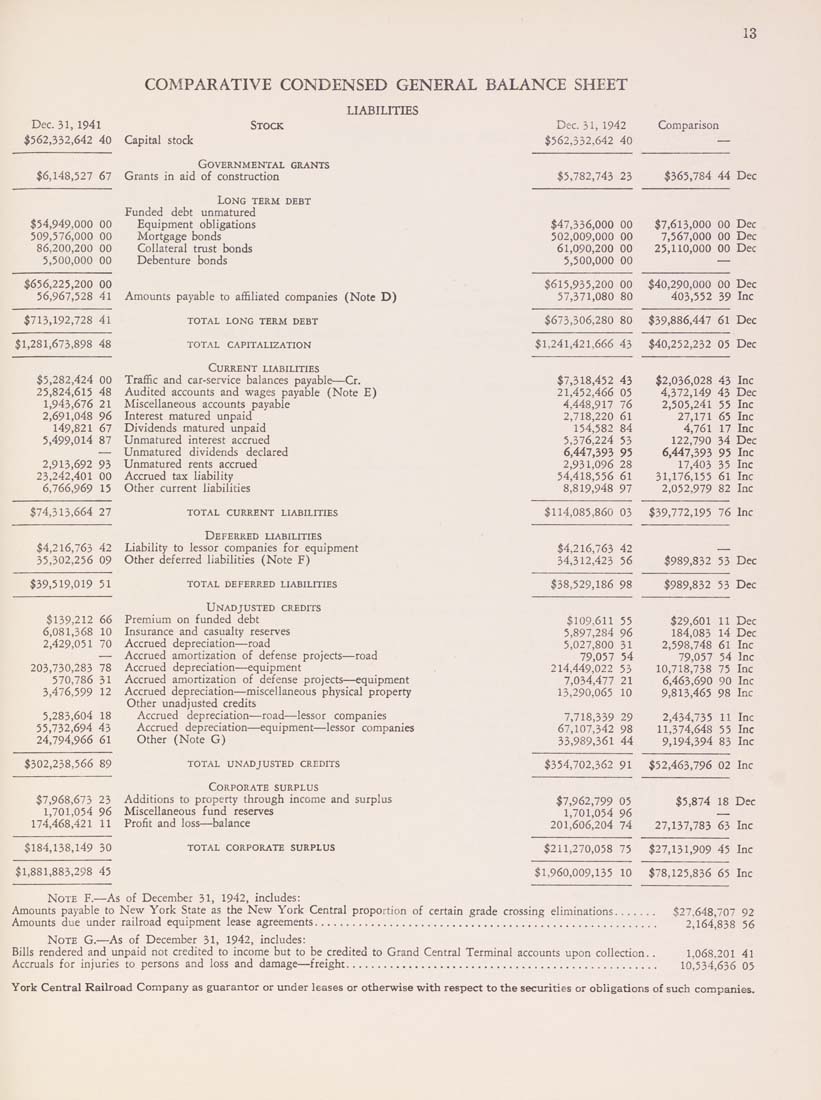

COMPARATIVE CONDENSED GENERAL BALANCE SHEET

LIABILITIES

Dec. 31, 1941

$562,332,642 40 Capital stock

Stock

Governmental grants

5,148,527 67 Grants in aid of construction

Dec. 31, 1942 Comparison

$562,332,642 40

$5,782,743 23 $365,784 44 Dec

Long term debt

Funded debt unmatured

$54,949,000 00 Equipment obligations $47,336,000 00 $7,613,000 00 Dec

509,576,000 00 Mortgage bonds 502,009,000 00 7,567,000 00 Dec

86,200,200 00 Collateral trust bonds 61,090,200 00 25,110,000 00 Dec

5,500,000 00 Debenture bonds 5,500,000 00 —

$656,225,200 00 $615,935,200 00 $40,290,000 00 Dec

56,967,528 4l Amounts payable to affiliated companies (Note D) 57,371,080 80 403,552 39 Inc

$713,192,728 41 total long term debt $673,306,280 80 $39,886,447 61 Dec

$1,281,673,898 48 total capitalization $1,241,421,666 43 $40,252,232 05 Dec

Current liabilities

$5,282,424 00 Traffic and car-service balances payable—Cr. $7,318,452 43 $2,036,028 43 Inc

25,824,615 48 Audited accounts and wages payable (Note E) 21,452,466 05 4,372,149 43 Dec

1,943,676 21 Miscellaneous accounts payable 4,448,917 76 2,505,241 55 Inc

2,691,048 96 Interest matured unpaid 2,718,220 61 27,171 65 Inc

149,821 67 Dividends matured unpaid 154,582 84 4,761 17 Inc

5,499,014 87 Unmatured interest accrued 5,376,224 53 122,790 34 Dec

— Unmatured dividends declared 6,447,393 95 6,447,393 95 Inc

2,913,692 93 Unmatured rents accrued 2,931,096 28 17,403 35 Inc

23,242,401 00 Accrued tax liability 54,418,556 61 31,176,155 61 Inc

6,766,969 15 Other current liabilities 8,819,948 97 2,052,979 82 Inc

$74,313,664 27 total current liabilities $114,085,860 03 $39,772,195 76 Inc

Deferred liabilities

$4,216,763 42 Liability to lessor companies for equipment $4,216,763 42 —

35,302,256 09 Other deferred liabilities (Note F) 34,312,423 56 $989,832 53 Dec

$39,519,019 51 total deferred liabilities $38,529,186 98 $989,832 53 Dec

Unadjusted credits

$139,212 66 Premium on funded debt $109,611 55 $29,601 11 Dec

6,081,368 10 Insurance and casualty reserves 5,897,284 96 184,083 14 Dec

2,429,051 70 Accrued depreciation—road 5,027,800 31 2,598,748 61 Inc

— Accrued amortization of defense projects—road 79,057 54 79,057 54 Inc

203,730,283 78 Accrued depreciation—equipment 214,449,022 53 10,718,738 75 Inc

570,786 31 Accrued amortization of defense projects—equipment 7,034,477 21 6,463,690 90 Inc

3,476,599 12 Accrued depreciation—miscellaneous physical property 13,290,065 10 9,813,465 98 Inc

Other unadjusted credits

5,283,604 18 Accrued depreciation—road—lessor companies 7,718,339 29 2,434,735 11 Inc

55,732,694 43 Accrued depreciation—equipment—lessor companies 67,107,342 98 11,374,648 55 Inc

24,794,966 61 Other (Note G) 33,989,361 44 9,194,394 83 Inc

$302,238,566 89 total unadjusted credits $354,702,362 91 $52,463,796 02 Inc

Corporate surplus

$7,968,673 23 Additions to property through income and surplus $7,962,799 05 $5,874 18 Dec

1,701,054 96 Miscellaneous fund reserves 1,701,054 96 __

174,468,421 11 Profit and loss—balance 201,606,204 74 27,137,783 63 Inc

$184,138,149 30 total corporate surplus $211,270,058 75 $27,131,909 45 Inc

$1,881,883,298 45 $1,960,009,135 10 $78,125,836 65 Inc

Note F.—As of December 31, 1942, includes:

Amounts payable to New York State as the New York Central proportion of certain grade crossing eliminations....... $27,648,707 92

Amounts due under railroad equipment lease agreements....................................................... 2,164,838 56

Note G.—As of December 31, 1942, includes:

Bills rendered and unpaid not credited to income but to be credited to Grand Central Terminal accounts upon collection. . 1,068.201 41

Accruals for injuries to persons and loss and damage—freight.................................................. 10,534,636 05

York Central Railroad Company as guarantor or under leases or otherwise with respect to the securities or obligations of such companies.

|