14

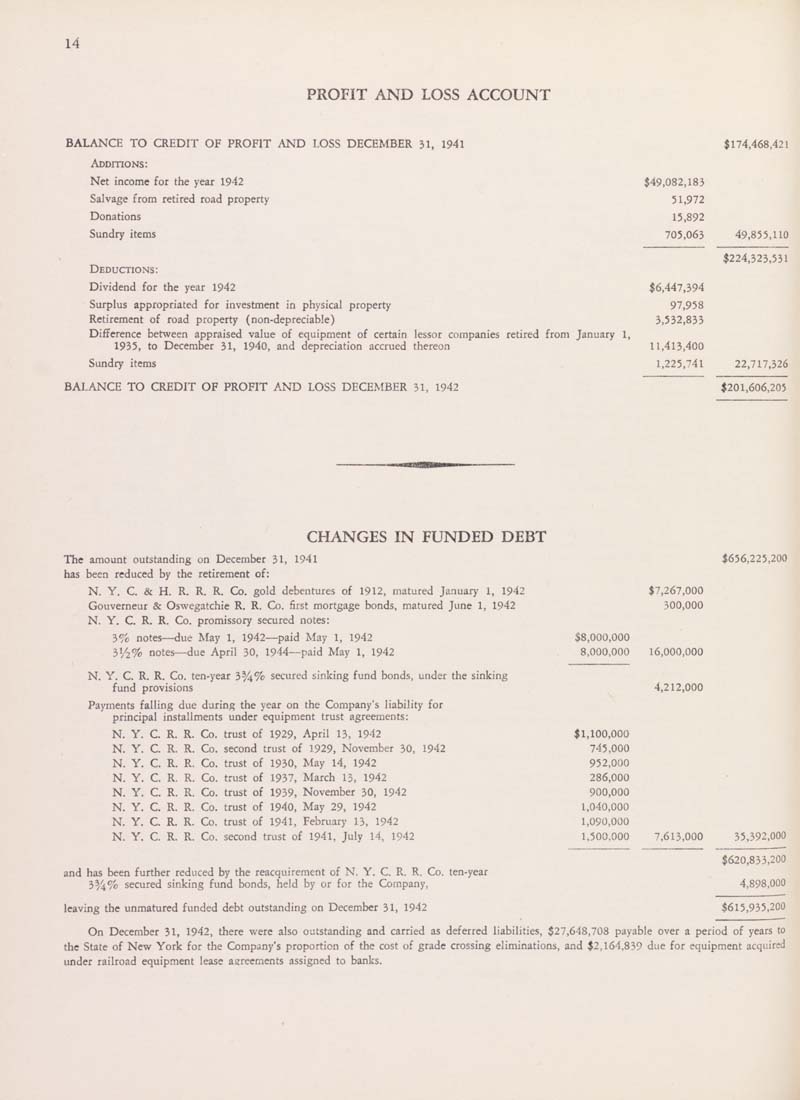

PROFIT AND LOSS ACCOUNT

BALANCE TO CREDIT OF PROFIT AND LOSS DECEMBER 31, 1941

Additions:

Net income for the year 1942

Salvage from retired road property

Donations

Sundry items

Deductions:

Dividend for the year 1942

Surplus appropriated for investment in physical property

Retirement of road property (non-depreciable)

Difference between appraised value of equipment of certain lessor companies retired from January 1,

1935, to December 31, 1940, and depreciation accrued thereon

Sundry items

BALANCE TO CREDIT OF PROFIT AND LOSS DECEMBER 31, 1942

$174,468,421

$49,082,183

51,972

15,892

705,063

49,855,110

$224,323,531

$6,447,394

97,958

3,532,833

11,413,400

1,225,741

22,717,326

$201,606,205

CHANGES IN FUNDED DEBT

The amount outstanding on December 31, 1941

has been reduced by the retirement of:

N. Y. C. & H. R. R. R. Co. gold debentures of 1912, matured January 1, 1942

Gouverneur & Oswegatchie R. R. Co. first mortgage bonds, matured June 1, 1942

N. Y. C. R. R. Co. promissory secured notes:

3?c notes—due May 1, 1942—paid May 1, 1942

31/2% notes—due April 30, 1944—paid May 1, 1942

N. Y. C. R. R. Co. ten-year 3^4% secured sinking fund bonds, under the sinking

fund provisions

Payments falling due during the year on the Company's liability for

principal installments under equipment trust agreements:

N. Y. C. R. R. Co. trust of 1929, April 13, 1942

N. Y. C. R. R. Co. second trust of 1929, November 30, 1942

N. Y. C. R. R. Co. trust of 1930, May 14, 1942

N. Y. C. R. R. Co. trust of 1937, March 13, 1942

N. Y. C. R. R. Co. trust of 1939, November 30, 1942

N. Y. C. R. R. Co. trust of 1940, May 29, 1942

N. Y. C. R. R. Co. trust of 1941, February 13, 1942

N. Y. C. R. R. Co. second trust of 1941, July 14, 1942

and has been further reduced by the reacquirement of N. Y. C. R. R. Co. ten-year

3^4% secured sinking fund bonds, held by or for the Company,

leaving the unmatured funded debt outstanding on December 31, 1942

$7,267,000

300,000

$8,000,000

8,000,000 16,000,000

$1,100,000

745,000

952,000

286,000

900,000

1,040,000

1,090,000

1,500,000

4,212,000

7,613,000

$656,225,200

35,392,000

$620,833,200

4,898,000

$615,935,200

On December 31, 1942, there were also outstanding and carried as deferred liabilities, $27,648,708 payable over a period of years to

the State of New York for the Company's proportion of the cost of grade crossing eliminations, and $2,164,839 due for equipment acquired

under railroad equipment lease agreements assigned to banks.

|