19

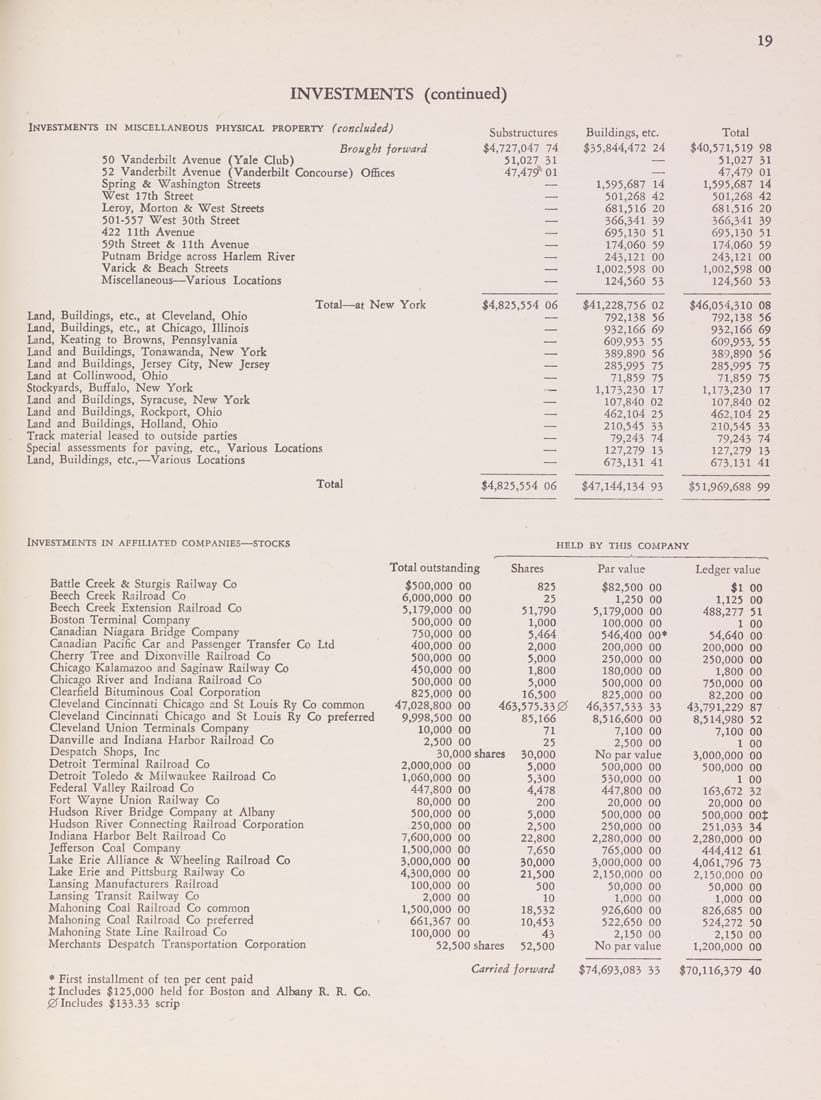

INVESTMENTS (continued)

Investments in miscellaneous physical property (concluded)

Brought forward

50 Vanderbilt Avenue (Yale Club)

52 Vanderbilt Avenue (Vanderbilt Concourse) Offices

Spring & Washington Streets

West 17th Street

Leroy, Morton & West Streets

501-557 West 30th Street

422 11th Avenue

59th Street & 11th Avenue

Putnam Bridge across Harlem River

Varick & Beach Streets

Miscellaneous—Various Locations

Land, Buildings, etc., at Cleveland, Ohio

Land, Buildings, etc., at Chicago, Illinois

Land, Keating to Browns, Pennsylvania

Land and Buildings, Tonawanda, New York

Land and Buildings, Jersey City, New Jersey

Land at Collinwood, Ohio

Stockyards, Buffalo, New York

Land and Buildings, Syracuse, New York

Land and Buildings, Rockport, Ohio

Land and Buildings, Holland, Ohio

Track material leased to outside parties

Special assessments for paving, etc.. Various Locations

Land, Buildings, etc.,—Various Locations

Total—at New York

Total

Substructures

Buildings, etc.

Total

$4,727,047 74

$35,844,472 24

$40,571,519 98

51,027 31

—

51,027 31

47,479'' 01

—

47,479 01

—

1,595,687 14

1,595,687 14

—

501,268 42

501,268 42

—

681,516 20

681,516 20

—

366,341 39

366,341 39

—

695,130 51

695,130 51

—

174,060 59

174,060 59

—

243,121 00

243,121 00

—

1,002,598 00

1,002,598 00

—

124,560 53

124,560 53

$4,825,554 06

$41,228,756 02

$46,054,310 08

—

792,138 56

792,138 56

—

932,166 69

932,166 69

—

609,953 55

609,953, 55

—

389,890 56

389,890 56

—

285,995 75

285,995 75

—

71,859 75

71,859 75

—

1,173,230 17

1,173,230 17

—

107,840 02

107,840 02

—

462,104 25

462,104 25

—

210,545 33

210,545 33

—

79,243 74

79,243 74

—

127,279 13

127,279 13

—

673,131 41

673,131 41

$4,825,554 06

$47,144,134 93

$51,969,688 99

Investments in affiliated companies—stocks

Battle Creek & Sturgis Railway Co

Beech Creek Railroad Co

Beech Creek Extension Railroad Co

Boston Terminal Company

Canadian Niagara Bridge Company

Canadian Pacific Car and Passenger Transfer Co Ltd

Cherry Tree and Dixonville Railroad Co

Chicago Kalamazoo and Saginaw Railway Co

Chicago River and Indiana Railroad Co

Clearfield Bituminous Coal Corporation

Cleveland Cincinnati Chicago and St Louis Ry Co common

Cleveland Cincinnati Chicago and St Louis Ry Co preferred

Cleveland Union Terminals Company

Danville and Indiana Harbor Railroad Co

Despatch Shops, Inc

Detroit Terminal Railroad Co

Detroit Toledo & Milwaukee Railroad Co

Federal Valley Railroad Co

Fort Wayne Union Railway Co

Hudson River Bridge Company at Albany

Hudson River Connecting Railroad Corporation

Indiana Harbor Belt Railroad Co

Jefferson Coal Company

Lake Erie Alliance & Wheeling Railroad Co

Lake Erie and Pittsburg Railway Co

Lansing Manufacturers Railroad

Lansing Transit Railway Co

Mahoning Coal Railroad Co common

Mahoning Coal Railroad Co preferred

Mahoning State Line Railroad Co

Merchants Despatch Transportation Corporation

* First installment of ten per cent paid

t Includes $125,000 held for Boston and Albany R. R. Co.

0Includes $133.33 scrip

held by this company

Total outstanding

Shares

Par value

Ledger value

$500,000 00

825

$82,500 00

$1 00

6,000,000 00

25

1,250 00

1,125 00

5,179,000 00

51,790

5,179,000 00

488,277 51

500,000 00

1,000

100,000 00

1 00

750,000 00

5,464

546,400 00*

54,640 00

400,000 00

2,000

200,000 00

200,000 00

500,000 00

5,000

250,000 00

250,000 00

450,000 00

1,800

180,000 00

1,800 00

500,000 00

5,000

500,000 00

750,000 00

825,000 00

16,500

825,000 00

82,200 00

47,028,800 00 463,575.330

46,357,533 33

43,791,229 87

9,998,500 00

85,166

8,516,600 00

8,514,980 52

10,000 00

71

7,100 00

7,100 00

2,500 00

25

2,500 00

1 00

30,000 shares

30,000

No par value

3,000,000 00

2,000,000 00

5,000

500,000 00

500,000 00

1,060,000 00

5,300

530,000 00

1 00

447,800 00

4,478

447,800 00

163,672 32

80,000 00

200

20,000 00

20,000 00

500,000 00

5,000

500,000 00

500,000 00$

250,000 00

2,500

250,000 00

251,033 34

7,600,000 00

22,800

2,280,000 00

2,280,000 00

1,500,000 00

7,650

765,000 00

444,412 61

3,000,000 00

30,000

3,000,000 00

4,061,796 73

4,300,000 00

21,500

2,150,000 00

2,150,000 00

100,000 00

500

50,000 00

50,000 00

2,000 00

10

1,000 00

1,000 00

1,500,000 00

18,532

926,600 00

826,685 00

661,367 00

10,453

522,650 00

524,272 50

100,000 00

43

2,150 00

2,150 00

52,500 shares

52,500

forward

No par value

1,200,000 00

Carried

$74,693,083 33

$70,116,379 40

|