20

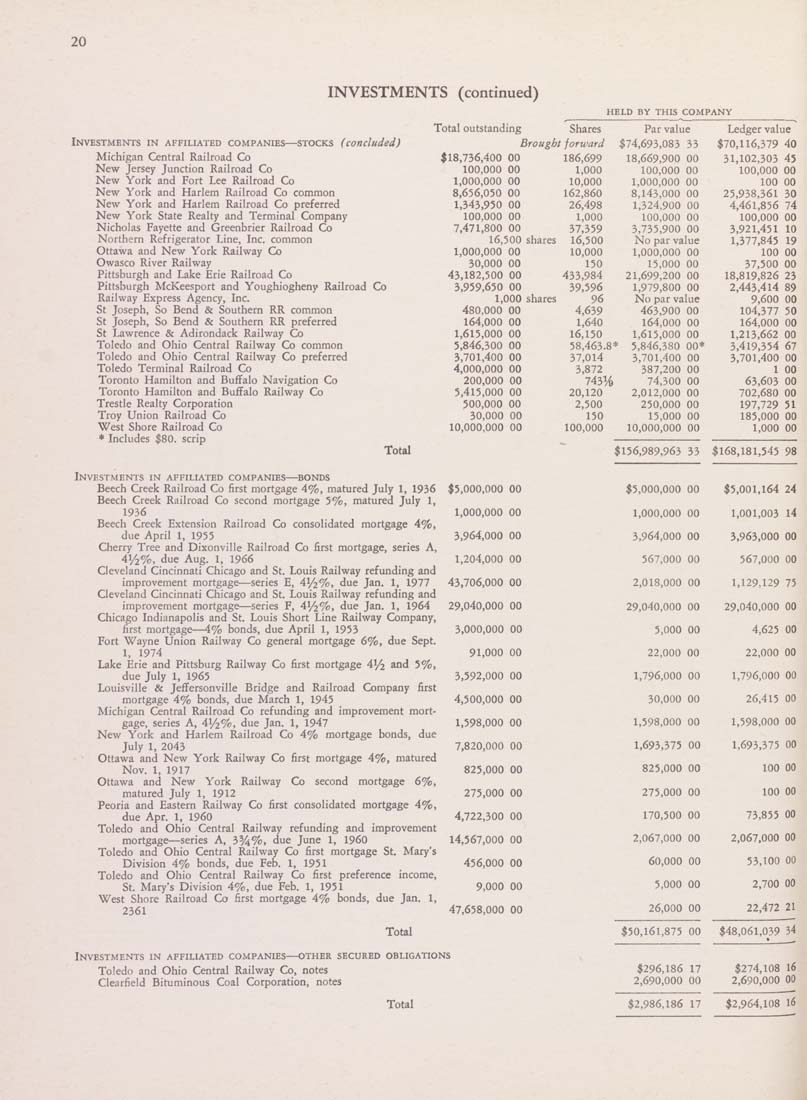

INVESTMENTS (continued)

HELD BY THIS COMPANY

Investments in affiliated companies—stocks (concluded)

Michigan Central Railroad Co

New Jersey Junction Railroad Co

New York and Fort Lee Railroad Co

New York and Harlem Railroad Co common

New York and Harlem Railroad Co preferred

New York State Realty and Terminal Company

Nicholas Fayette and Greenbrier Railroad Co

Northern Refrigerator Line, Inc. common

Ottawa and New York Railway Co

Owasco River Railway

Pittsburgh and Lake Erie Railroad Co

Pittsburgh McKeesport and Youghiogheny Railroad Co

Railway Express Agency, Inc.

St Joseph, So Bend & Southern RR common

St Joseph, So Bend & Southern RR preferred

St Lawrence & Adirondack Railway Co

Toledo and Ohio Central Railway Co common

Toledo and Ohio Central Railway Co preferred

Toledo Terminal Railroad Co

Toronto Hamilton and Buffalo Navigation Co

Toronto Hamilton and Buffalo Railway Co

Trestle Realty Corporation

Troy Union Railroad Co

West Shore Railroad Co

* Includes $80. scrip

Total

Investments in affiliated companies—bonds

Beech Creek Railroad Co first mortgage 4%, matured July 1, 1936

Beech Creek Railroad Co second mortgage 5%, matured July 1,

1936

Beech Creek Extension Railroad Co consolidated mortgage 4%,

due April 1, 1955

Cherry Tree and Dixonville Railroad Co first mortgage, series A,

41/2%, due Aug. 1, 1966

Cleveland Cincinnati Chicago and St. Louis Railway refunding and

improvement mortgage—series E, 41/2%, due Jan. 1, 1977

Cleveland Cincinnati Chicago and St. Louis Railway refunding and

improvement mortgage—series F, 41/2%, due Jan. 1, 1964

Chicago Indianapolis and St. Louis Short Line Railway Company,

first mortgage—4% bonds, due April 1, 1953

Fort Wayne Union Railway Co general mortgage 6%, due Sept.

1, 1974

Lake Erie and Pittsburg Railway Co first mortgage 41/2 and 5%,

due July 1, 1965

Louisville & JeffersonviUe Bridge and Railroad Company first

mortgage 4% bonds, due March 1, 1945

Michigan Central Railroad Co refunding and improvement mort¬

gage, series A, 41/2%, due Jan. 1, 1947

New York and Harlem Railroad Co 4% mortgage bonds, due

July 1, 2043

Ottawa and New York Railway Co first mortgage 4%, matured

Nov. 1, 1917

Ottawa and New York Railway Co second mortgage 6%,

matured July 1, 1912

Peoria and Eastern Railway Co first consolidated mortgage 4%,

due Apr. 1, I960

Toledo and Ohio Central Railway refunding and improvement

mortgage—series A, 3%%, due June 1, I960

Toledo and Ohio Central Railway Co first mortgage St. Mary's

Division 4% bonds, due Feb. 1, 1951

Toledo and Ohio Central Railway Co first preference income,

St. Mary's Division 4%, due Feb. 1, 1951

West Shore Railroad Co first mortgage 4% bonds, due Jan. 1,

2361

Total

Total outstanding

Shares

Par value

Ledger value

Brought forward

$74,693,083 33

$70,116,379 40

$18,736,400 00

186,699

18,669,900 00

31,102,303 45

100,000 00

1,000

100,000 00

100,000 00

1,000,000 00

10,000

1,000,000 00

100 00

8,656,050 00

162,860

8,143,000 00

25,938,361 30

1,343,950 00

26,498

1,324,900 00

4,461,856 74

100,000 00

1,000

100,000 00

100,000 00

7,471,800 00

37,359

3,735,900 00

3,921,451 10

16,500 shares

16,500

No par value

1,377,845 19

1,000,000 00

10,000

1,000,000 00

100 00

30,000 00

150

15,000 00

37,500 00

43,182,500 00

433,984

21,699,200 00

18,819,826 23

3,959,650 00

39,596

1,979,800 00

2,443,414 89

1,000 shares

96

No par value

9,600 00

480,000 00

4,639

463,900 00

104,377 50

164,000 00

1,640

164,000 00

164,000 00

1,615,000 00

16,150

1,615,000 00

1,213,662 00

5,846,300 00

58,463.8*

■ 5,846,380 00*

3,419,354 67

3,701,400 00

37,014

3,701,400 00

3,701,400 00

4,000,000 00

3,872

387,200 00

1 00

200,000 00

743%

74,300 00

63,603 00

5,415,000 00

20,120

2,012,000 00

702,680 00

500,000 00

2,500

250,000 00

197,729 51

30,000 00

150

15,000 00

185,000 00

10,000,000 00

100,000

10,000,000 00

1,000 00

$5,000,000 00

1,000,000 00

3,964,000 00

1,204,000 00

43,706,000 00

29,040,000 00

3,000,000 00

91,000 00

3,592,000 00

4,500,000 00

1,598,000 00

7,820,000 00

825,000 00

275,000 00

4,722,300 00

14,567,000 00

456,000 00

9,000 00

47,658,000 00

$156,989,963 33 $168,181,545 98

$5,000,000 00

1,000,000 00

3,964,000 00

567,000 00

2,018,000 00

29,040,000 00

5,000 00

22,000 00

1,796,000 00

30,000 00

1,598,000 00

1,693,375 00

825,000 00

275,000 00

170,500 00

2,067,000 00

60,000 00

5,000 00

26,000 00

$5,001,164 24

1,001,003 14

3,963,000 00

567,000 00

1,129,129 75

29,040,000 00

4,625 00

22,000 00

1,796,000 00

26,415 00

1,598,000 00

1,693,375 00

100 00

100 00

73,855 00

2,067.000 00

53,100 00

2,700 00

22,472 21

$50,161,875 00 $48,061,039 34

Investments in affiliated companies—other secured obligations

Toledo and Ohio Central Railway Co, notes

Clearfield Bituminous Coal Corporation, notes

Total

$296,186 17

2,690,000 00

$274,108 16

2,690,000 00

$2,986,186 17 $2,964,108 I6

|