22

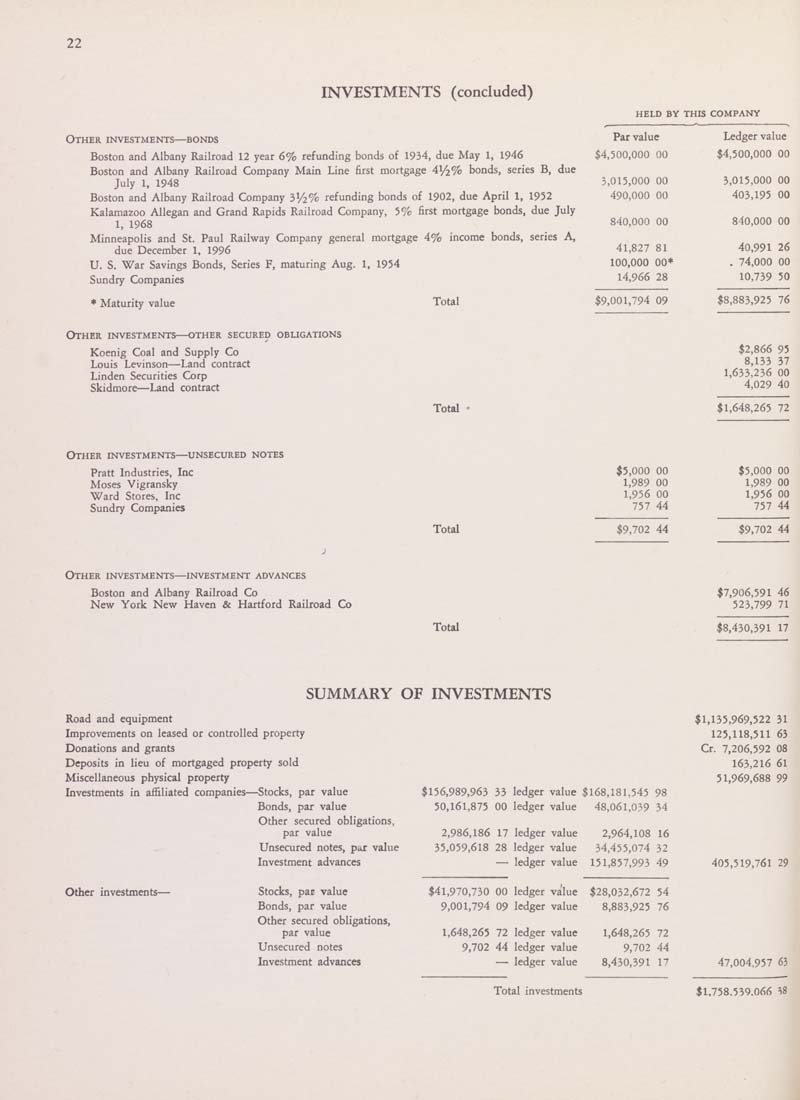

INVESTMENTS (concluded)

Other investments—bonds

Boston and Albany Railroad 12 year 6% refunding bonds of 1934, due May 1, 1946

Boston and Albany Railroad Company Main Line first mortgage 41/2% bonds, series B, due

July 1, 1948

Boston and Albany Railroad Company 31/2% refunding bonds of 1902, due April 1, 1952

Kalamazoo Allegan and Grand Rapids Railroad Company, 5% first mortgage bonds, due July

1, 1968

Minneapolis and St. Paul Railway Company general mortgage 4% income bonds, series A,

due December 1, 1996

U. S. War Savings Bonds, Series F, maturing Aug. 1, 1954

Sundry Companies

held by this company

Maturity value

Other investments—other secured obligations

Total

Koenig Coal and Supply Co

Louis Levinson—Land contract

Linden Securities Corp

Skidmore—Land contract

Other investments—unsecured notes

Total

Pratt Industries, Inc

Moses Vigransky

Ward Stores, Inc

Sundry Companies

Other investments—investment advances

Boston and Albany Railroad Co

New York New Haven & Hartford Railroad Co

Total

Total

Par value

Ledger value

$4,500,000

00

$4,500,000

00

3,015,000

00

3,015,000

00

490,000

00

403,195

00

840,000

00

840,000

00

41,827

81

40,991

26

100,000

00*

. 74,000

00

14,966

28

10,739

50

$9,001,794 09

$8,883,925

76

$2,866 95

8,133

37

1,633,236 00

4,029 40

$1,648,265 72

$5,000

00

$5,000

00

1,989

00

1,989

00

1,956 00

1,956

00

757

44

757

44

$9,702

44

$9,702

44

$7,906,591

46

523,799

71

$8,430,391

17

SUMMARY OF INVESTMENTS

Road and equipment

Improvements on leased or controlled property

Donations and grants

Deposits in lieu of mortgaged property sold

Miscellaneous physical property

Investments in affiliated companies

Other investments—

-Stocks, par value

Bonds, par value

Other secured obligations,

par value

Unsecured notes, par value

Investment advances

Stocks, par value

Bonds, par value

Other secured obligations,

par value

Unsecured notes

Investment advances

$156,989,963 33 ledger value $168,181,545 98

50,161,875 00 ledger value 48,061,039 34

2,986,186 17 ledger value

35,059,618 28 ledger value

— ledger value

$41,970,730 00 ledger value

9,001,794 09 ledger value

1,648,265 72 ledger value

9,702 44 ledger value

— ledger value

2,964,108 16

34,455,074 32

151,857,993 49

$28,032,672 54

8,883,925 76

1,648,265 72

9,702 44

8,430,391 17

$1,135,969,522 31

125,118,511 63

Cr. 7,206,592 08

163,216 61

51,969,688 99

405,519,761 29

47,004,957 63

Total investments

$1,758,539,066 38

|