21

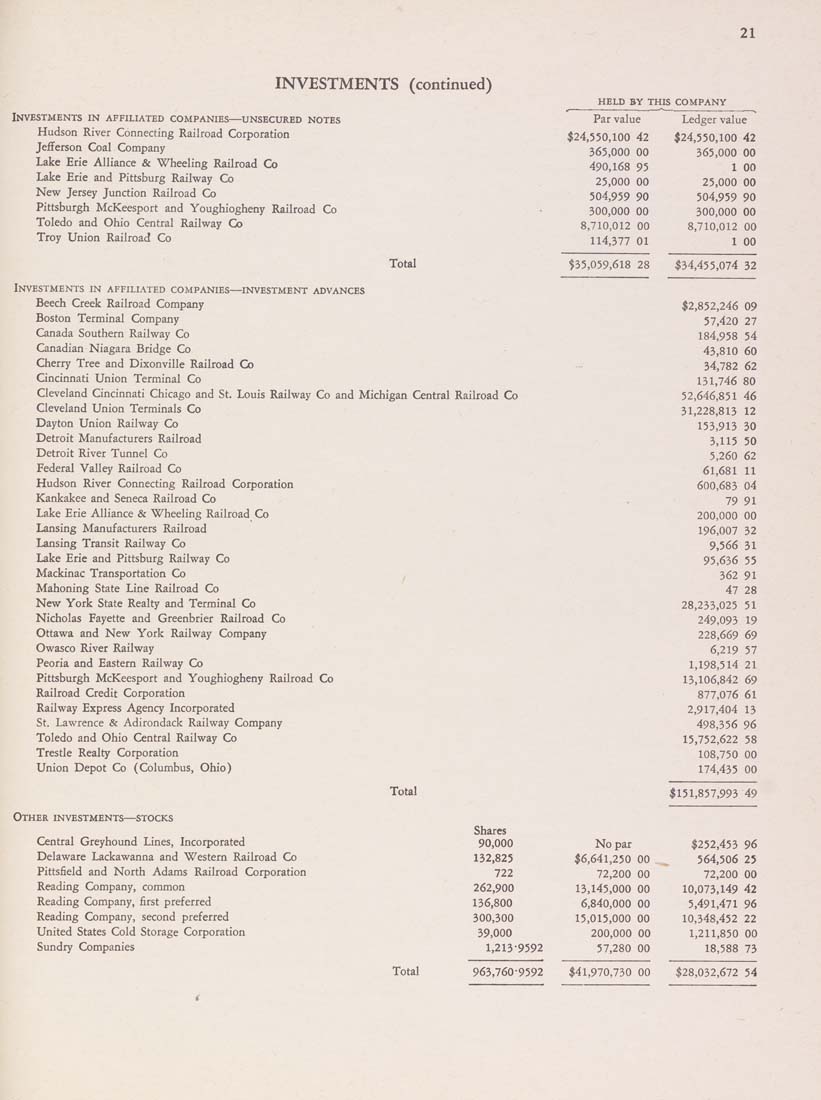

INVESTMENTS (continued)

held by this company

Investments in affiliated companies—unsecured notes

Hudson River Connecting Railroad Corporation

Jefferson Coal Company

Lake Erie Alliance & Wheeling Railroad Co

Lake Erie and Pittsburg Railway Co

New Jersey Junction Railroad Co

Pittsburgh McKeesport and Youghiogheny Railroad Co

Toledo and Ohio Central Railway Co

Troy Union Railroad Co

Total

Investments in affiliated companies—investment advances

Beech Creek Railroad Company

Boston Terminal Company

Canada Southern Railway Co

Canadian Niagara Bridge Co

Cherry Tree and Dixonville Railroad Co

Cincinnati Union Terminal Co

Cleveland Cincinnati Chicago and St. Louis Railway Co and Michigan Central Railroad Co

Cleveland Union Terminals Co

Dayton Union Railway Co

Detroit Manufacturers Railroad

Detroit River Tunnel Co

Federal Valley Railroad Co

Hudson River Connecting Railroad Corporation

Kankakee and Seneca Railroad Co

Lake Erie Alliance & Wheeling Railroad Co

Lansing Manufacturers Railroad

Lansing Transit Railway Co

Lake Erie and Pittsburg Railway Co

Mackinac Transportation Co

Mahoning State Line Railroad Co

New York State Realty and Terminal Co

Nicholas Fayette and Greenbrier Railroad Co

Ottawa and New York Railway Company

Owasco River Railway

Peoria and Eastern Railway Co

Pittsburgh McKeesport and Youghiogheny Railroad Co

Railroad Credit Corporation

Railway Express Agency Incorporated

St. Lawrence & Adirondack Railway Company

Toledo and Ohio Central Railway Co

Trestle Realty Corporation

Union Depot Co (Columbus, Ohio)

Total

Other investments—stocks

Central Greyhound Lines, Incorporated

Delaware Lackawanna and Western Railroad Co

Pittsfield and North Adams Railroad Corporation

Reading Company, common

Reading Company, first preferred

Reading Company, second preferred

United States Cold Storage Corporation

Sundry Companies

Par value

$24,550,100 42

365,000 00

490,168 95

25,000 00

504,959 90

300,000 00

8,710,012 00

114,377 01

Ledger value

$24,550,100 42

365,000 00

1 00

25,000 00

504,959 90

300,000 00

8,710,012 00

1 00

$35,059,618 28 $34,455,074 32

$2,852,246 09

57,420 27

184,958 54

43,810 60

34,782 62

131,746 80

52,646,851 46

31,228,813 12

153,913 30

3,115 50

5,260 62

61,681 11

600,683 04

79 91

200,000 00

196,007 32

9,566 31

95,636 55

362 91

47 28

28,233,025 51

249,093 19

228,669 69

6,219 57

1,198,514 21

13,106,842 69

877,076 61

2,917,404 13

498,356 96

15,752,622 58

108,750 00

174,435 00

$151,857,993 49

Shares

90,000

No par

$252,453 96

132,825

$6,641,250 00

564,506 25

722

72,200 00

72,200 00

262,900

13,145,000 00

10,073,149 42

136,800

6,840,000 00

5,491,471 96

300,300

15,015,000 00

10,348,452 22

39,000

200,000 00

1,211,850 00

1,213-9592

57,280 00

18,588 73

Total

963,760-9592 $41,970,730 00

5,032,672 54

|