18

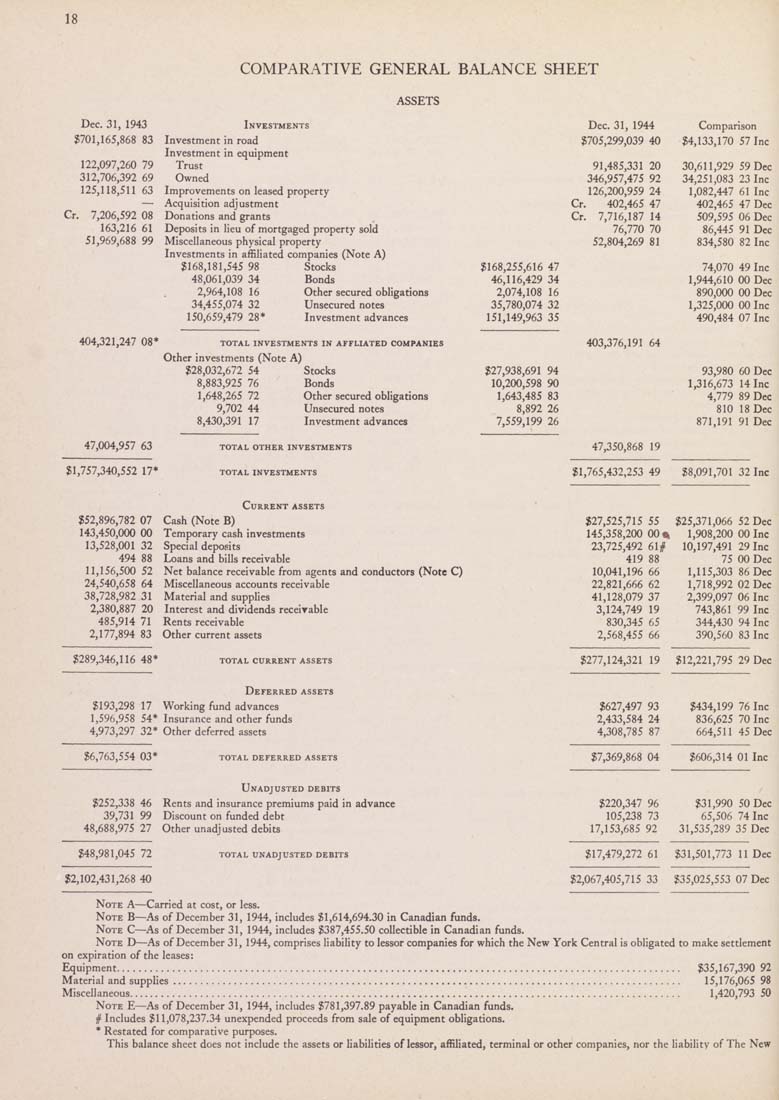

COMPARATIVE GENERAL BALANCE SHEET

ASSETS

Dec. 31, 1943

$701,165,868 83

122,097,260 79

312,706,392 69

125,118,511 63

Investments

Cr.

7,206,592 08

163,216 61

51,969,688 99

Investment in road

Investment In equipment

Trust

Owned

Improvements on leased property

Acquisition adjustment

Donations and grants

Deposits In lieu of mortgaged property sold

Miscellaneous physical property

Investments In affiliated companies (Note A)

$168,181,545 98 Stocks

48,061,039 34 Bonds

2,964,108 16 Other secured obligations

34,455,074 32 Unsecured notes

150,659,479 28* Investment advances

404,321,247 08"

total investments in affliated companies

Other Investments (Note A)

$28,032,672 54 Stocks

8,883,925 76 Bonds

1,648,265 72 Other secured obligations

9,702 44 Unsecured notes

8,430,391 17 Investment advances

47,004,957 63

$1,757,340,552 17*

total other investments

total investments

Current assets

$52,896,782 07 Cash (Note B)

143,450,000 00 Temporary cash investments

13,528,001 32 Special deposits

494 88 Loans and bills receivable

11,156,500 52 Net balance receivable from agents and conductors (Note C)

24,540,658 64 Miscellaneous accounts receivable

38,728,982 31 Material and supplies

2,380,887 20 Interest and dividends recelrable

485,914 71 Rents receivable

2,177,894 83 Other current assets

$289,346,116 48''

TOTAL CURRENT ASSETS

Deferred assets

$193,298 17 Working fund advances

1,596,958 54* Insurance and other funds

4,973,297 32* Other deferred assets

5,763,554 03*

TOTAL DEFERRED ASSETS

Dec. 31, 1944

Comparison

$705,299,039 40

$4,133,170 57 Inc

91,485,331 20

30,611,929 59 Dec

346,957,475 92

34,251,083 23 Inc

126,200,959 24

1,082,447 61 Inc

Cr. 402,465 47

402,465 47 Dec

Cr. 7,716,187 14

509,595 06 Dec

76,770 70

86,445 91 Dec

52,804,269 81

834,580 82 Inc

$168,255,616 47

74,070 49 Inc

46,116,429 34

1,944,610 00 Dec

2,074,108 16

890,000 00 Dec

35,780,074 32

1,325,000 00 Inc

151,149,963 35

403,376,191 64

490.484 07 Inc

$27,938,691 94

93,980 60 Dec

10,200,598 90

1,316,673 14 Inc

1,643,485 83

4,779 89 Dec

8,892 26

810 18 Dec

7,559,199 26

47,350,868 19

871,191 91 Dec

$1,765,432,253 49

$8,091,701 32 Inc

$27,525,715 55

$25,371,066 52 Dec

145,358,200 00 «

1,908,200 00 Inc

23,725,492 61 #

10,197,491 29 Inc

419 88

75 00 Dec

10,041,196 66

1,115,303 86 Dec

22,821,666 62

1,718,992 02 Dec

41,128,079 37

2,399,097 06 Inc

3,124,749 19

743,861 99 Inc

830,345 65

344,430 94 Inc

2,568,455 66

390,560 83 Inc

$277,124,321 19

$12,221,795 29 Dec

$627,497 93

$434,199 76 Inc

2,433,584 24

836,625 70 Inc

4,308,785 87

664,511 45 Dec

$7,369,868 04

$606,314 01 Inc

Unadjusted debits

$252,338 46 Rents and Insurance premiums paid In advance $220,347 96 $31,990 50 Dec

39,731 99 Discount on funded debt 105,238 73 65,506 74 Inc

48,688,975 27 Other unadjusted debits 17,153,685 92 31,535,289 35 Dec

$48,981,045 72 total unadjusted debits $17,479,272 61 $31,501,773 11 Dec

$2,102,431,268 40 $2,067,405,715 33 $35,025,553 07 Dec

Note A—Carried at cost, or less.

Note B—As of December 31, 1944, Includes $1,614,694.30 in Canadian funds.

Note C—As of December 31, 1944, Includes $387,455.50 collectible in Canadian funds.

Note D—As of December 31, 1944, comprises liability to lessor companies for which the New York Central Is obligated to make settlement

on expiration of the leases:

Equipment..................................................................................................... $35,167,390 92

Material and supplies........................................................................................... 15,176,065 98

Miscellaneous................................................................................................... 1,420,793 50

Note E—As of December 31, 1944, Includes $781,397.89 payable in Canadian funds.

# Includes $11,078,237.34 unexpended proceeds from sale of equipment obligations.

* Restated for comparative purposes.

This balance sheet does not include the assets or liabilities of lessor, affiliated, terminal or other companies, nor the liability of The New

|