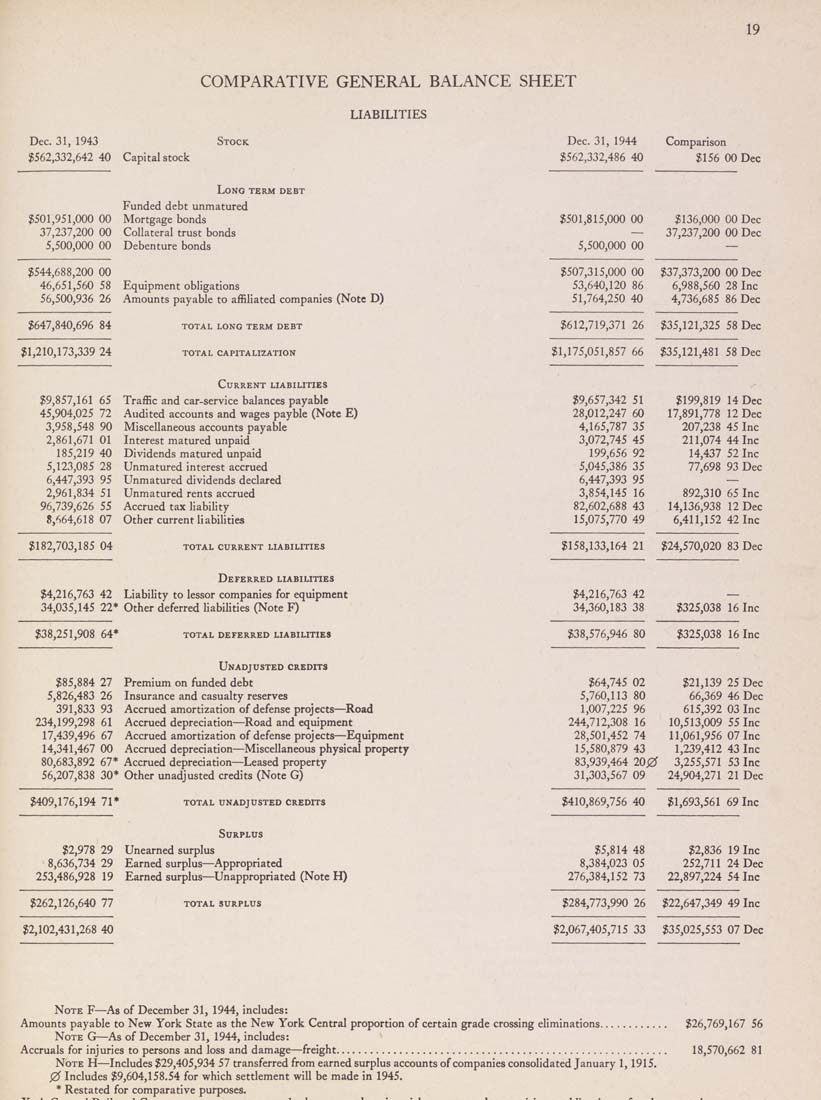

COMPARATIVE GENERAL BALANCE SHEET

19

LIABILITIES

Dec. 31, 1943 Stock

$562,332,642 40 Capital stock

Long term debt

Funded debt unmatured

$501,951,000 00 Mortgage bonds

37,237,200 00 Collateral trust bonds

5,500,000 00 Debenture bonds

$544,688,200 00

46,651,560 58 Equipment obligations

56,500,936 26 Amounts payable to affiliated companies (Note D)

$647,840,696 84

$1,210,173,339 24

$9,857,161 65

45,904,025 72

3,958,548 90

2,861,671 01

185,219 40

5,12.1,085 28

6,447,393 95

2,961,834 51

96,739,626 55

8,664,618 07

$182,703,185 04

total long term debt

total capitalization

Current liabilities

Traffic and car-service balances payable

Audited accounts and wages payble (Note E)

Miscellaneous accounts payable

Interest matured unpaid

Dividends matured unpaid

Unmatured Interest accrued

Unmatured dividends declared

Unmatured rents accrued

Accrued tax liability

Other current liabilities

total CURRENT LIABILITIES

Deferred liabilities

$4,216,763 42 Liability to lessor companies for equipment

34,035,145 22* Other deferred liabilities (Note F)

TOTAL deferred LIABILITIES

Unadjusted credits

Premium on funded debt

Insurance and casualty reserves

Accrued amortization of defense projects—Road

Accrued depreciation—Road and equipment

Accrued amortization of defense projects—Equipment

Accrued depreciation—Miscellaneous physical property

Accrued depreciation—Leased property

Other unadjusted credits (Note G)

TOTAL unadjusted CREDITS

Surplus

$2,978 29 Unearned surplus

8,636,734 29 Earned surplus—Appropriated

253,486,928 19 Earned surplus—Unappropriated (Note H)

$38,251,908 64*

$85,884 27

5,826,483 26

391,833 93

234,199,298 61

17,439,496 67

14,341,467 00

80,683,892 67*

56,207,838 30*

$409,176,194 71*

$262,126,640 77

$2,102,431,268 40

TOTAL SURPLUS

Dec. 31, 1944

$562,332,486 40

Comparison

$156 00 Dec

$501,815,000 00

5,500,000 00

$136,000 00 Dec

37,237,200 00 Dec

$507,315,000 00

53,640,120 86

51,764,250 40

$37,373,200 00 Dec

6,988,560 28 Inc

4,736,685 86 Dec

$612,719,371 26

$35,121,325 58 Dec

$1,175,051,857 66

$35,121,481 58 Dec

$9,657,342 51

28,012,247 60

4,165,787 35

3,072,745 45

199,656 92

5,045,386 35

6,447,393 95

3,854,145 16

82,602,688 43

15,075,770 49

$199,819 14 Dec

17,891,778 12 Dec

207,238 45 Inc

211,074 44 Inc

14,437 52 Inc

77,698 93 Dec

892,310 65 Inc

14,136,938 12 Dec

6,411,152 42 Inc

$158,133,164 21

$24,570,020 83 Dec

$4,216,763 42

34,360,183 38

$325,038 16 Inc

$38,576,946 80

$325,038 16 Inc

$64,745 02 $21,139 25 Dec

5,760,113 80 66,369 46 Dec

1,007,225 96 615,392 03 Inc

244,712,308 16 10,513,009 55 Inc

28,501,452 74 11,061,956 07 Inc

15,580,879 43 1,239,412 43 Inc

83,939,464 200 3,255,571 53 Inc

31,303,567 09 24,904,271 21 Dec

$410,869,756 40

$1,693,561 69 Inc

$5,814 48 $2,836 19 Inc

8,384,023 05 252,711 24 Dec

276,384,152 73 22,897,224 54 Inc

$284,773,990 26 $22,647,349 49 Inc

$2,067,405,715 33 $35,025,553 07 Dec

Note F—As of December 31, 1944, Includes:

Amounts payable to New York State as the New York Central proportion of certain grade crossing eliminations..........

Note G—As of December 31, 1944, Includes:

Accruals for Injuries to persons and loss and damage—freight.......................................................

Note H—Includes $29,405,934 57 transferred from earned surplus accounts of companies consolidated January 1,1915.

0 Includes $9,604,158.54 for which settlement will be made in 1945.

* Restated for comparative purposes.

$26,769,167 56

18,570,662 81

|