31

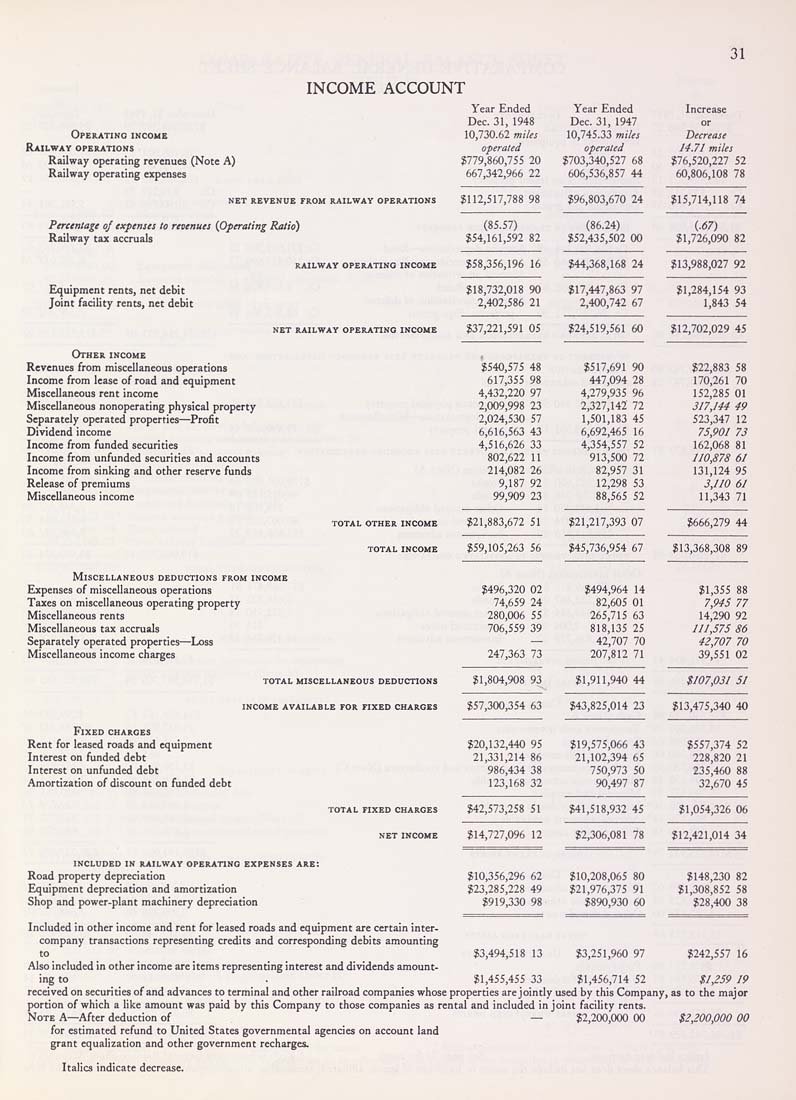

INCOME ACCOUNT

Operating income

Railwav operations

Railway operating revenues (Note A)

Railway operating expenses

NET REVENUE FROM RAILWAY OPERATIONS

Percentage of expenses to revenues {Operating Ratio)

Railway tax accruals

Equipment rents, net debit

Joint facility rents, net debit

RAILWAY OPERATING INCOME

NET RAILWAY OPERATING INCOME

Other income

Revenues from miscellaneous operations

Income from lease of road and equipment

Miscellaneous rent income

Miscellaneous nonoperating physical property

Separately operated properties—Profit

Dividend income

Income from funded securities

Income from unfunded securities and accounts

Income from sinking and other reserve funds

Release of premiums

Miscellaneous income

Miscellaneous deductions from income

Expenses of miscellaneous operations

Taxes on miscellaneous operating property

Miscellaneous rents

Miscellaneous tax accruals

Separately operated properties—Loss

Miscellaneous income charges

TOTAL MISCELLANEOUS DEDUCTIONS

AVAILABLE FOR FIXED CHARGES

Fixed charges

Rent for leased roads and equipment

Interest on funded debt

Interest on unfunded debt

Amortization of discount on funded debt

TOTAL FIXED CHARGES

NET INCOME

Year Ended

Dec. 31, 1948

10,730.62 mites

operated

$779,860,755 20

667,342,966 22

Year Ended

Dec. 31, 1947

10,745.33 mites

operated

?703,340,527 68

606,536,857 44

$112,517,788 98

C85.!7)

854,161,592 82

$58,356,196 16

$18,732,018 90

2,402,586 21

$37,221,591 05

$540,575 48

617,355 98

4,432,220 97

2,009,998 23

2,024,530 57

6,616,563 43

4,516,626 33

802,622 11

214,082 26

9,187 92

99,909 23

I MCOME $21,883,672 51

I INCOME $59,105,263 56

(86.24)

$52,435,502 00

$17,447,863 97

2,400,742 67

$24,519,561 60

$517,691 90

447,094 28

4,279,935 96

2,327,142 72

1,501,183 45

6,692,465 16

4,354,557 52

913,500 72

82,957 31

12,298 53

88,565 52

$21,217,393 07

$496,320 02

74,659 24

280,006 55

706,559 39

247,363 73

$494,964 14

82,605 01

265,715 63

818,135 25

42,707 70

207,812 71

$1,911,940 44

$20,132,440 95

21,331,214 86

986,434 38

123,168 32

$19,575,066 43

21,102,394 65

750,973 50

90,497 87

$42,573,258 51 $41,518,932 45

$14,727,096 12

$10,356,296 62 $10,208,065 80

$23,285,228 49 $21,976,375 91

$919,330 98 $890,930 60

Increase

Decrease

14.71 miles

$76,520,227 52

60,806,108 78

3,670 24 $15,714,118 74

(.67)

$1,726,090 82

$13,988,027 92

$1,284,154 93

1,843 54

$22,883 58

170,261 70

152,285 01

317,144 49

523,347 12

75,901 73

162,068 81

nO,S7S 61

131,124 95

3,110 61

11,343 71

$666,179 44

$45,736,954 67 $13,368,308 89

$1,355 88

7,943 77

14,290 92

1H,S7S 86

42,707 70

39,551 02

$107P31 51

$57,300,354 63 $43,825,014 23 $13,475,340 40

$557,374 52

228,820 21

235,460 88

32,670 45

$1,054,326 06

$12,421,014 34

$148,230 82

$1,308,852 58

$28,400 38

INCLUDED IN RAILWAY OPERATING EXPENSES ARE!

Road property depreciation

Equipment depreciation and amortization

Shop and power-plant machinery depreciation

Included in other income and rent for leased roads and equipment are certain inter¬

company transactions representing credits and corresponding debits amounting

to $3,494,518 13 $3,251,960 97 $242,557 16

Also included in other income are items representing interest and dividends amount¬

ing to . $1,455,455 33 $1,456,714 52 tl,lS9 19

received on securities of and advances to terminalandother railroad companies whose properties are jointly used by this Company, as to the major

portion of which a lijte amount was paid by this Company to those companies as rental and included in joint facility rents.

Note A—After deducdon of — $2,200,000 00 $2,300,000 00

for estimated refund to United States governmental agencies on account land

grant equalization and other government recharges.

Italics indicate decrease.

|