36

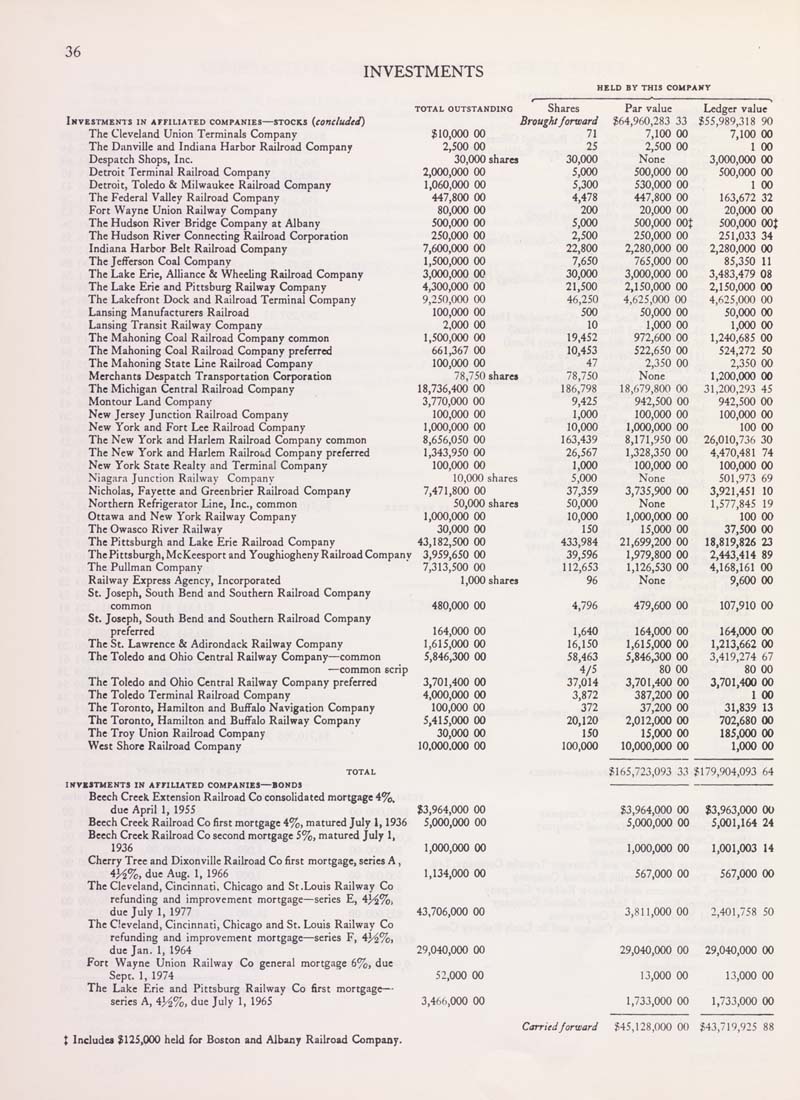

INVESTMENTS

HELD BV THIS COMPANY

IkTESTMEI^IS in AFFILIATED COMPANIES—STOCKS {cOTIcluded)

The Cleveland Union Terminals Company

The Danville and Indiana Harbor Railroad Company

Despatch Shops, Inc.

Detroit Terminal Railroad Company

Detroit, Toledo & Milwaukee Railroad Company

The Federal Valley Railroad Company

Fort Wayne Union Railway Company

The Hudson River Bridge Company at Albany

The Hudson River Connecting Railroad Corporation

Indiana Harbor Belt Railroad Company

The Jefferson Coal Company

The Lake Erie, Alliance & Wheeling Railroad Company

The Lake Eric and Pittsburg Railway Company

The Lakefront Dock and Railroad Terminal Company

Lansing Manufacturers Railroad

Lansing Transit Railway Company

The Mahoning Coal Railroad Company common

The Mahoning Coal Railroad Company preferred

The Mahoning State Line Railroad Company

Merchants Despatch Transportation Corporation

The Michigan Central Railroad Company

Montour Land Company

New Jersey Junction Railroad Company

New York and Fort Lee Railroad Company

The New York and Harlem Railroad Company common

The New York and Harlem Railroad Company preferred

New York State Realty and Terminal Company

Niagara Junction Railway Company

Nicholas, Fayette and Greenbrier Railroad Company

Northern Refrigerator Line, Inc., common

Ottawa and New York Railway Company

The Owasco River Railway

The Pittsburgh and Lake Eric Railroad Company

ThePittsburgh, McKeesport and Youghiogheny Railroad Company

The Pullman Company

Railway Express Agency, Incorporated

St, Joseph, South Bend and Southern Railroad Company

common

St. Joseph, South Bend and Southern Railroad Company

preferred

The St. Lawrence & Adirondack Railway Company

The Toledo and Ohio Central Railway Company—common

—common scrip

The Toledo and Ohio Central Railway Company preferred

The Toledo Terminal Railroad Company

The Toronto, Hamilton and Buffalo Navigation Company

The Toronto, Hamilton and Buffalo Railway Company

The Troy Union Railroad Company

West Shore Railroad Company

TOTAL

INVBSTMENTS IN AFFILIATED COMPANIES—BONDS

Beech Creek Extension Railroad Co consoHdatcd mortgage 4%,

due April 1, 1955

Beech Creek Railroad Co first mortgage 4%, matured July 1,1936

Beech Creek Railroad Co second mortgage 5%, matured July 1,

1936

Cherry Tree and Dixonville Railroad Co first mortgage, series A,

4H%, due Aug. 1, 1966

The Cleveland, Cincinnati, Chicago and St.Louis Railway Co

refunding and improvement mortgage—series E, 43^%,

due July 1, 1977

The Cleveland, Cincinnati, Chicago and St, Louis Railway Co

refunding and improvement mortgage—series F, 4J^%,

due Jan. 1, 1964

Fort Wayne Union Railway Co general mortgage 6%, due

Sept. 1, 1974

The Lake Erie and Pittsburg Railway Co first mortgage—

series A, 4J^%, due July 1, 1965

X Includes 2125,000 held for Boston and Albany Railroad Company.

TOTAL OUTSTANDING

Shares

Par value

Ledger value

Brought forward

$64,960,283 33

$55,989,318 90

$10,000 00

71

7,100 00

7,100 00

2,500 00

25

2,500 00

1 00

30,000 shares

30,000

None

3,000,000 00

2,000,000 00

5,000

500,000 00

500,000 00

1,060,000 00

5,300

530,000 00

1 00

447,800 00

4,478

447,800 00

163,672 32

80,000 00

200

20,000 00

20,000 00

500,000 00

5,000

500,000 OOt

500,000 OOJ

250,000 00

2,500

250,000 00

251,033 34

7,600,000 00

22,800

2,280,000 00

2,280,000 00

1,500,000 00

7,650

765,000 00

85,350 11

3,000,000 00

30,000

3,000,000 00

3,483,479 08

4,300,000 00

21,500

2,150,000 00

2,150,000 00

9,250,000 00

46,250

4,625,000 00

4,625,000 00

100,000 00

500

50,000 00

50,000 00

2,000 00

10

1,000 00

1,000 OO

1,500,000 00

19,452

972,600 00

1,240,685 00

661,367 00

10,453

522,650 00

524,272 50

100,000 00

47

2,350 00

2,350 00

78,750 shares

78,750

None

1,200,000 00

18,736,400 00

186,798

18,679,800 00

31,200,293 45

3,770,000 00

9,425

942,500 00

942,500 00

100,000 00

1,000

100,000 OO

100,000 00

1,000,000 00

10,000

1,000,000 00

100 00

8,656,050 00

163,439

8,171,950 00

26,010,736 30

1,343,950 00

26,567

1,328,350 00

4,470,481 74

100,000 00

1,000

100,000 00

100,000 00

10,000 shares

5,000

None

501.973 69

7,471,800 00

37,359

3,735,900 00

3,921,451 10

50,000 shares

50,000

None

1,577,845 19

1,000,000 00

10,000

1,000,000 00

100 OO

30,000 00

150

15,000 00

37,500 00

43,182,500 00

433,984

21,699,200 00

18,819,826 23

3,959,650 OO

39,596

1,979,800 OO

2,443,414 89

7,313,500 00

112,653

1,126,530 00

4,168,161 00

1,000 shares

96

None

9,600 00

480,000 00

4,796

479,600 00

107,910 OO

164,000 00

1,640

164,000 00

164,000 00

1,615,000 00

16,150

1,615,000 00

1,213,662 00

5,846,300 00

58,463

5,846,300 00

3,419,274 67

4/5

80 00

80 00

3,701,400 00

37,014

3,701,400 00

3,701,400 00

4,000,000 00

3,872

387,200 00

1 00

100,000 00

372

37,200 00

31,839 13

5,415,000 00

20,120

2,012,000 00

702,680 00

30,000 00

150

15,000 00

185,000 00

10.000.000 00

100,000

10,000,000 00

1,000 00

$165,723,093 33 $179,904,093 64

$3,964,000 00

5,000,000 00

1,000,000 00

1,134,000 00

43,706,000 00

29,040,000 00

52,000 00

3,466,000 00

$3,964,000 00 $3,963,000 OO

5,000,000 00 5,001,164 24

1,000,000 00 1,001.003 14

567,000 00 567,000 00

3,811,000 00 2,401,758 50

29,040,000 00 29,040,000 00

13,000 00 13,000 00

1,733,000 00 1,733,000 00

Carried forward $45,128,000 00 $43,719,925 I

|