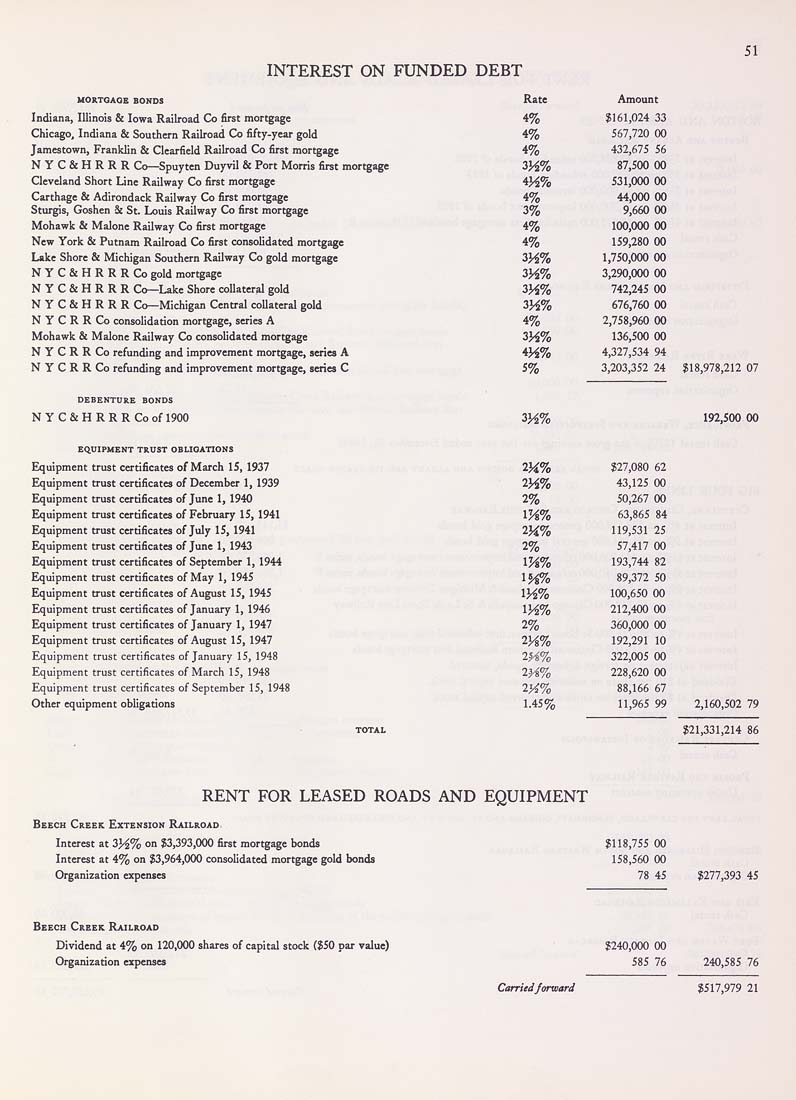

INTEREST ON FUNDED DEBT

UORTOAQE BONDS

Indiana, Illinois & Iowa Railroad Co first mortgage

Chicago, Indiana & Southern Railroad Co fifty-year gold

Jamestown, Franklin & Clearfield Rdlroad Co first mortgage

NYC&HRRR Co—Spuyten Duyvil & Port Morris first mortgage

Cleveland Short Line Railway Co first mortgage

Carthage & Adirondack Railway Co first mortgage

Stui^s, Goshen & St, Louis Railway Co first mortgage

Mohawk & Malone Railway Co first mortgage

New York & Putnam R^lroad Co first consolidated mortgage

Lake Shore & Michigan Southern R^lway Co gold mortgage

N Y C & H R R R Co gold mortage

NYC&HRRR Co—Lake Shore coUateral gold

NYC&HRRR Co—Michigan Central coUateral gold

N Y C R R Co consolidation mortgage, series A

Mohawk & Malone Railway Co consolidated mortgage

N Y C R R Co refunding and improvement mortgage, series A

N Y C R R Co refunding and improvement mortage, series C

DEBENTURE BONDS

NYC&HRRR Co of 1900

Equi

Equi

E,ui

Etjui

Equi

Equ:

Equi

Equi

Eqni

Equi

Equi

Equi

Equi

Equi

Equi

EQUIPMENT TRUST OBLIGATIONS

pment trust certificates of March 15, 1937

pment trust certificates of December 1, 1939

pment trust certificates of June 1, 1940

pment trust certificates of February 15, 1941

pment trust certificates of July 15,1941

pment trust certificates of June I, 1943

pment trust certificates of September 1, 1944

pment trust certificates of May 1, 1945

pment trust certificates of August 15, 1945

pment trust certificates of January 1, 1946

pment trust certificates of January 1, 1947

pment trust certificates of August 15, 1947

ipment trust certificates of January 15, 1948

pment trust certificates of March 15, 1948

:nt trust certificates of" September 15, 1948

Other equipment obligatii

Rate

Amount

4%

$161,024 33

4%

567,720 00

4%

432,675 56

3K%

87,500 00

4H%

531,000 00

4%

44,000 00

3%

9,660 00

4%

100,000 00

4%

159,280 00

3H%

1,750,000 00

3H%

3,290,000 00

3H%

742,245 00

3H%

676,760 00

4%

2,758,960 00

3M%

136,500 00

4H%

4,327,534 94

5%

3,203,352 24 $18,978,212 07

3H%

192,500 00

V4.%

$27,080 62

2H%

43,125 00

2%

50,267 00

1H%

63,865 84

2H%

119,531 25

2%

57,417 00

1H%

193,744 82

IJ^o

89,372 50

1M%

100,650 00

1M%

212,400 00

2%

360,000 00

2H%

192,291 10

2H%

322,005 00

2H%

228,620 00

2'A%

88,166 67

L45%

11,965 99 2,160,502 79

$21,331,214 86

RENT FOR LEASED ROADS AND EQUIPMENT

Beech Creek Extension Railroad

Interest at 3M% on $3,393,000 first mortgage bonds

Interest at 4% on $3,964,000 consolidated mortgage gold bonds

' n expenses

$118,755 00

158,560 00

78 45

$277,393 45

Beech Creek Railroad

Dividend at 4% on 120,000 shares of capital stock ($50 par value)

Organization expenses

Carried forward

$240,000 00

585 76 240,585 76

$517,979 21

|