68

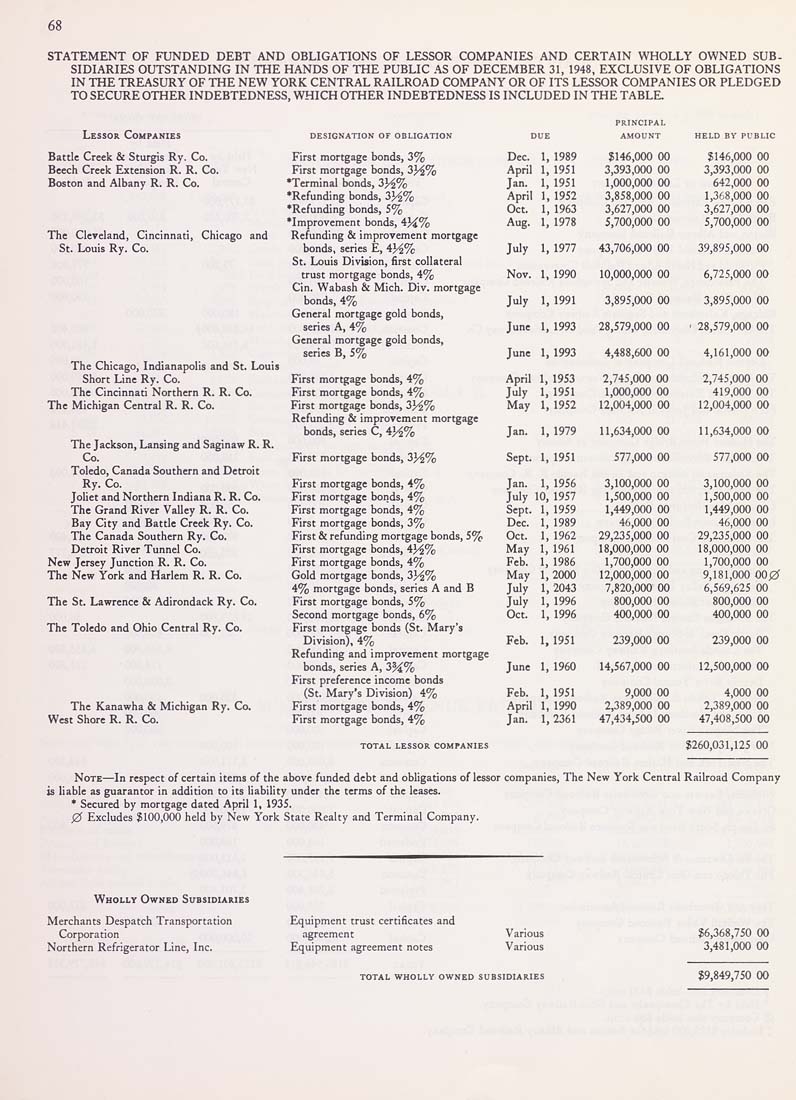

STATEMENT OF FUNDED DEBT AND OBLIGATIONS OF LESSOR COMPANIES AND CERTAIN WHOLLY OWNED SUB¬

SIDIARIES OUTSTANDING IN THE HANDS OF THE PUBLIC AS OF DECEMBER 31, 1948, EXCLUSIVE OF OBLIGATIONS

IN THE TREASURY OF THE NEW YORK CENTRAL RAILROAD COMPANY OR OF ITS LESSOR COMPANIES OR PLEDGED

TO SECURE OTHER INDEBTEDNESS, WHICH OTHER INDEBTEDNESS IS INCLUDED IN THE TABLE.

Lessor Companies

Battle Creek & Sturgis Ry. Co.

Beech Creek Extension R. R. Co.

Boston and Albany R, R. Co.

The Cleveland, Ci

St. Louis Ry. Co,

, Chicago and

The Chicago, Indianapolis and St. Louis

Short Line Ry. Co.

The Cincinnati Northern R. R. Co.

The Michigan Central R. R, Co,

The Jackson, Lansing and Saginaw R. R,

Co.

Toledo, Canada Southern and Detroit

Ry. Co.

Joliet and Northern Indiana R. R. Co.

The Grand River Valley R. R. Co.

Bay City and Battle Creek Ry. Co.

The Canada Southern Ry, Co.

Detroit River Tunnel Co,

New Jersey Junction R. R. Co.

The New York and Harlem R. R. Co.

The St. Lawrence & Adirondack Ry. Co.

The Toledo and Ohio Central Ry. Co.

The Kanawha & Michigan Ry. Co.

West Shore R. R. Co.

DESIGNATION OF OBLIGATION

First mortgage bonds, 3%

First mortgage bonds, 3J^%

'Terminal bonds, 3J^%

•Refunding bonds, 3^%

•Refunding bonds, 5%

•Improvement bonds, 4J^%

Refunding & improvement mortgage

bonds, series E, 4^%

St. Louis Division, first collateral

trust mortgage bonds, 4%

Cin. Wabash & Mich. Div. mortgage

bonds, 4%

General mortgage gold bonds,

series A, 4%

Genera! mortgage gold bonds,

series B, 5%

First mortgage bonds, 4%

First mortgage bonds, 4%

First mortgage bonds, 3H%

Refunding & improvement mortgage

bonds, series C, 4)^%

First mortgage bonds, 3J^%

First mortgage bonds, 4%

First mortgage bonds, 4%

First mortgage bonds, 4%

First mortgage bonds, 3%

First & refundirg mortgage bonds, S%

First mortgage bonds, 4J^%

First mortgage bonds, 4%

Gold mortgage bonds, 33^%

4% mortgage bonds, series A and B

First mortgage bonds, S%

Second mortgage bonds, 6%

First mortgage bonds (St. Mary's

Division), 4%

Refunding and improvement mortgage

bonds, series A, 3^%

First preference income bonds

(St. Mary's Division) 4%

First mortgage bonds, 4%

First mortgage bonds, 4%

TOTAL LESSOR COMPANIES

DUE

AMOUNT

HELD BY PUBLIC

Dec.

, 1989

$146,000 00

$146,000 00

April

, 1951

3,393,000 00

3,393,000 00

Jan. 1

, 1951

1,000,000 00

642,000 00

April

, 1952

3,858,000 00

1,368,000 00

Oct.

, 1963

3,627,000 00

3,627,000 00

Aug.

, 1978

5,700,000 00

5,700,000 00

July

, 1977

43,706,000 00

39,895,000 00

Nov. 1

, 1990

10,000,000 00

6,725,000 00

July

, 1991

3,895,000 00

3,895,000 00

June

,1993

28,579,000 00

■ 28,579,000 00

June

,1993

4,488,600 00

4,161,000 00

April 1

,1953

2,745,000 00

2,745,000 00

July 1

, 1951

1,000,000 00

419,000 00

May

, 1952

12,004,000 00

12,004,000 00

Jan.

, 1979

11,634,000 00

11,634,000 00

Sept. 1

, 1951

577,000 00

577,000 00

Jan. 1

, 1956

3,100,000 00

3,100,000 00

July 10

, 1957

1,500,000 00

1,500,000 00

Sept. 1

, 1959

1,449,000 00

1,449,000 00

Dec. 1

, 1989

46,000 00

46,000 00

Oct. 1

, 1962

29,235,000 00

29,235,000 00

May :

, 1961

18,000,000 00

18,000,000 00

Feb. 1

, 1986

1,700,000 00

1,700,000 00

May

,2000

12,000,000 00

9,181,000 000

July

,2043

7,820,000 00

6,569,625 00

July

, 1996

800,000 00

800,000 00

Oct.

, 1996

400,000 00

400,000 00

Feb. 1

,1951

239,000 00

239,000 00

June

, 1960

14,567,000 00

12,500,000 00

Feb. 1

, 1951

9,000 00

4,000 00

April

, 1990

2,389,000 00

2,389,000 00

Jan.

,2361

47,434,500 00

47,408,500 00

$260,031,125 00

Note—In respect of certain items of the above funded debt and obligations of lessor companies, The New York Central Railroad Company

is liable as guarantor in addition to its habllity under the terms of the leases.

• Secured by mortgage dated April I, 1935.

0 Excludes $100,000 held by New York State Realty and Terminal Company.

Wholly Owned Subsidiaries

Merchants Despatch Transportation

Corporation

Northern Refrigerator Line, Inc.

Equipment trust certificates and

agreement Various

Equipment agreement notes Various

$6,368,750 00

3,481,000 00

OWNED SUBSIDIARIES

|