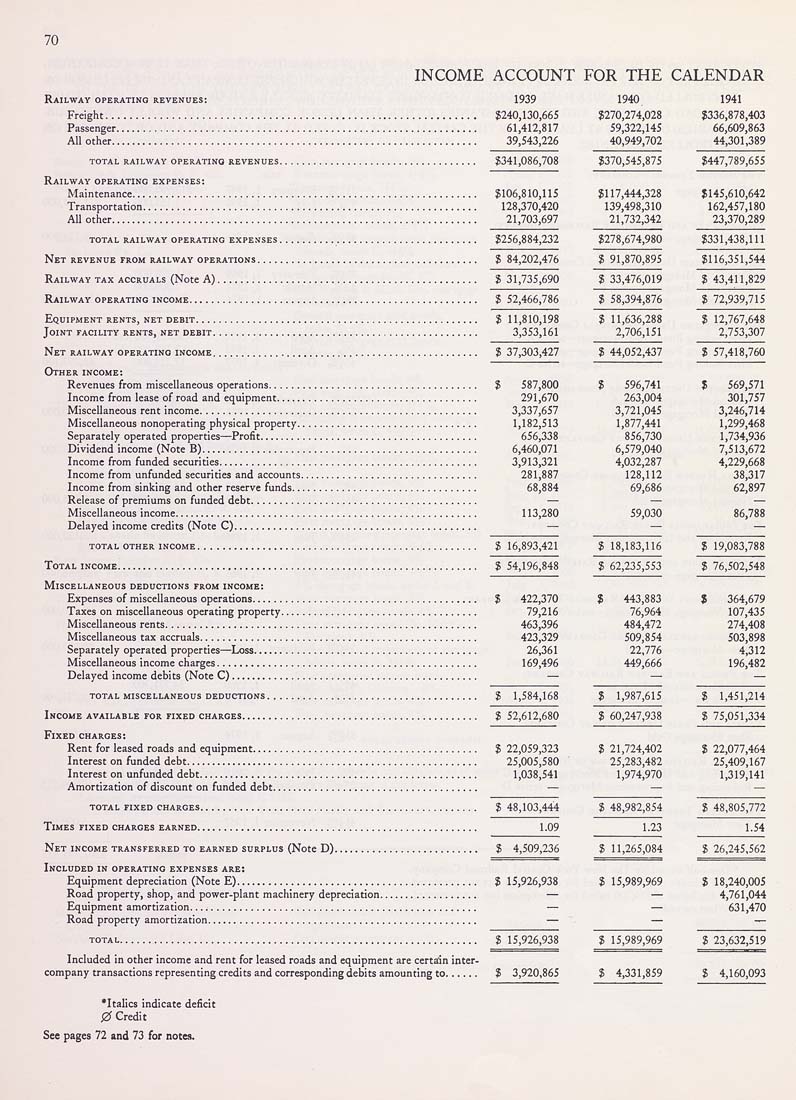

70

INCOME ACCOUNT FOR THE CALENDAR

Railway operating revenues: 1939 1940 1941

Freight.............................................................. $240,130,665 $270,274,028 $336,878,403

Passenger................................................................ 61,412,817 59,322,145 66,609,863

All other................................................................. 39,543,226 40,949,702 44,301,389

total railway operating revenues................................... $341,086,708 $370,545,875 $447,789,655

Railway operating expenses:

Maintenance............................................................. $106,810,115 $117,444,328 $145,610,642

Transportation........................................................... 128,370,420 139,498,310 162,457,180

All other................................................................. 21,703,697 21,732,342 23,370,289

TOTAL RAILWAY OPERATING EXPENSES................................... $256,884,232 $278,674,980 $331,438,111

Net revenue from railway operations....................................... $ 84,202,476 $ 91,870,895 $116,351,544

Railway tax accruals (Note A).............................................. $ 31,735,690 $ 33,476,019 $ 43,411,829

Railway OPERATING INCOME................................................... $ 52,466,786 $ 58,394,876 $ 72,939,715

Equipment rents, net debit.................................................. $ 11,810,198 $ 11,636,288 $ 12,767,648

Joint facility rents, net debit............................................... 3,353,161 2,706,151 2,753,307

Net railway operating income............................................... $ 37,303,427 $ 44,052,437 $ 57,418,760

Other income:

Revenues from miscellaneous operations..................................... $ 587,800 $ 596,741 $ 569,571

Income from lease of road and equipment.................................... 291,670 263,004 301,757

Miscellaneous rent income................................................. 3,337,657 3,721,045 3,246,714

Miscellaneous nonoperating physical property................................ 1,182,513 1,877,441 1,299,468

Separately operated properties—Profit....................................... 656,338 856,730 1,734,936

Dividend income (Note B)................................................. 6,460,071 6,579,040 7,513,672

Income from funded securities.............................................. 3,913,321 4,032,287 4,229,668

Income from unfunded securities and accounts................................ 281,887 128,112 38,317

Income from sinking and other reserve funds................................. 68,884 69,686 62,897

Release of premiums on funded debt........................................ — — —

Miscellaneous income...................................................... 113,280 59,030 86,788

Delayed income credits (Note C)........................................... ~ — —

total other income................................................. $ 16,893,42! $ 18,183,116 $ 19,083,788

Total income!............................................................... $ 54,196,848 $ 62,235,553 $ 76,502,548

Miscellaneous deductions from income:

Expenses of miscellaneous operations........................................ $ 422,370 $ 443,883 $ 364,679

Taxes on miscellaneous operating property................................... 79,216 76,964 107,435

Miscellaneous rents....................................................... 463,396 484,472 274,408

Miscellaneous tax accruals................................................. 423,329 509,854 503,898

Separately operated properties—Loss........................................ 26,361 22,776 4,312

Miscellaneous income charges.............................................. 169,496 449,666 196,482

Delayed income debits (Note C)............................................ — — —

total miscellaneous deductions..................................... $ 1,584,168 $ 1,987,615 $ 1,451,214

Income available for fixed charges.......................................... $ 52,612,680 $ 60,247,938 $ 75,051,334

Fixed charges:

Rent for leased roads and equipment........................................ $ 22,059,323 $ 21,724,402 $ 22,077,464

Interest on funded debt..................................................... 25,005,580 25,283,482 25,409,167

Interest on unfunded debt.................................................. 1,038,541 1,974,970 1,319,141

Amortization of discount on funded debt..................................... — — —

total fixed charges................................................. $ 48,103,444 $ 48,982,854 $ 48,805,772

Times fixed charges earned.................................................. 1.09 1.23 1.54

Net income transferred to earned surplus (Note D).......................... $ 4,509,236 $ 11,265,084 $ 26,245,562

Included in operating expenses are:

Equipment depreciation (Note E)........................................... $ 15,926,938 $ 15,989,969 $ 18,240,005

Road property, shop, and power-plant machinery depreciation.................. — — 4,761,044

Equipment amortization................................................... — — 631,470

Road property amortization................................................ — — —

TOTAL............................................................... $ 15,926,938 $ 15,989,969 $ 23,632,519

Included in other income and rent for leased roads and equipment are certain inter¬

company transactions representing credits and corresponding debits amounting to...... $ 3,920,865 $ 4,331,859 $ 4,160,093

•Itahcs indicate deficit

0 Credit

See pages 72 and 73 for notes.

|