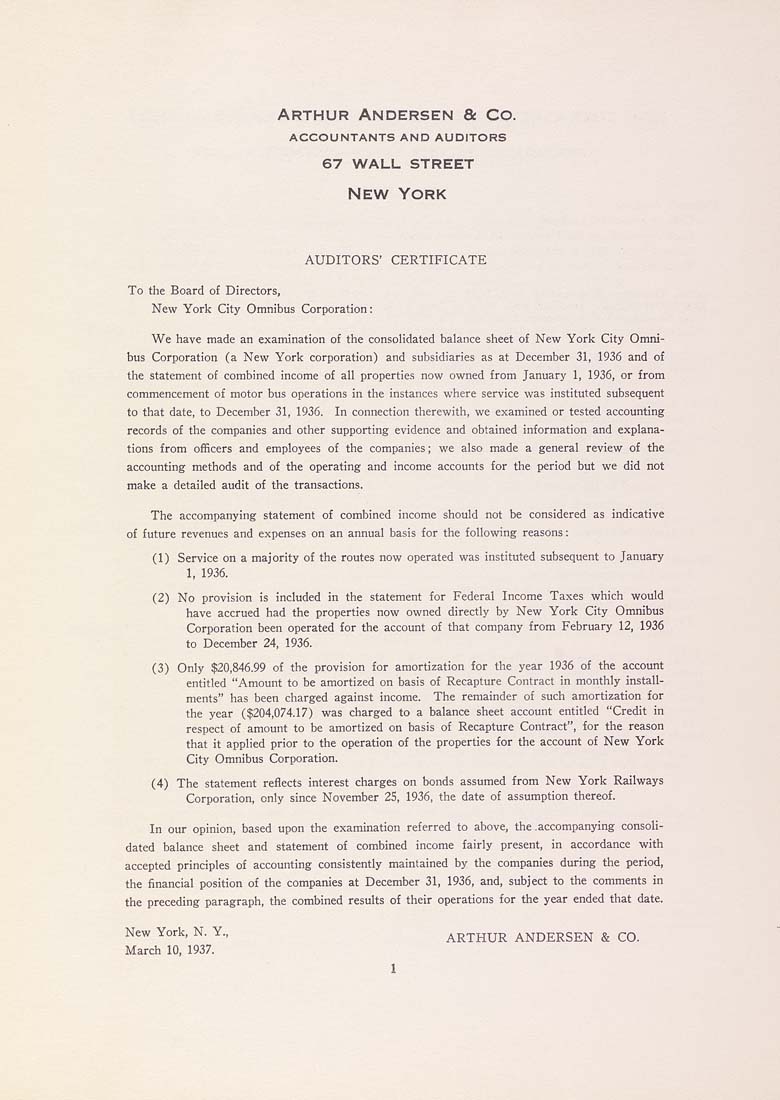

Arthur Andersen & Co.

ACCOUNTANTS AND AUDITORS

67 WALL STREET

NEW York

AUDITORS' CERTIFICATE

To the Board of Directors,

New York City Omnibus Corporation:

We have made an examination of the consolidated balance sheet of New York City Omni¬

bus Corporation (a New York corporation) and subsidiaries as at December 31, 1936 and of

the statement of combined income of all properties now owned from January I, 1936, or from

commencement of motor bus operations in the instances where service was instituted subsequent

to that date, to December 31, 1936. In connection therewith, we examined or tested accounting

records of the companies and other supporting evidence and obtained information and explana¬

tions from officers and employees of the companies; we also made a general review of the

accounting methods and of the operating and income accounts for the period but we did not

make a detailed audit of the transactions.

The accompanying statement of combined income should not be considered as indicative

of future revenues and expenses on an annual basis for the following reasons:

(1) Service on a majority of the routes now operated was instituted subsequent to January

1, 1936.

(2) No provision is included in the statement for Federal Income Taxes which would

have accrued had the properties now owned directly by New York City Omnibus

Corporation been operated for the account of that company from February 12, 1936

to December 24, 1936.

(3) Only $20,846.99 of the provision for amortization for the year 1936 of the accoimt

entitled "Amount to be amortized on basis of Recapture Contract in monthly install¬

ments" has been charged against income. The remainder of such amortization for

the year ($204,074.17) was charged to a balance sheet account entitled "Credit in

respect of amount to be amortized on basis of Recapture Contract", for the reason

that it applied prior to the operation of the properties for the account of New York

City Omnibus Corporation.

(4) The statement reflects interest charges on bonds assumed from New York Railways

Corporation, only since November 25, 1936, the date of assumption thereof.

In our opinion, based upon the examination referred to above, the .accompanying consoli¬

dated balance sheet and statement of combined income fairly present, in accordance with

accepted principles of accounting consistently maintained by the companies during the period,

the financial position of the companies at December 31, 1936, and, subject to the comments in

the preceding paragraph, the combined results of their operations for the year ended that date.

New York, N. Y., ARTHUR ANDERSEN & CO.

March 10, 1937.

|