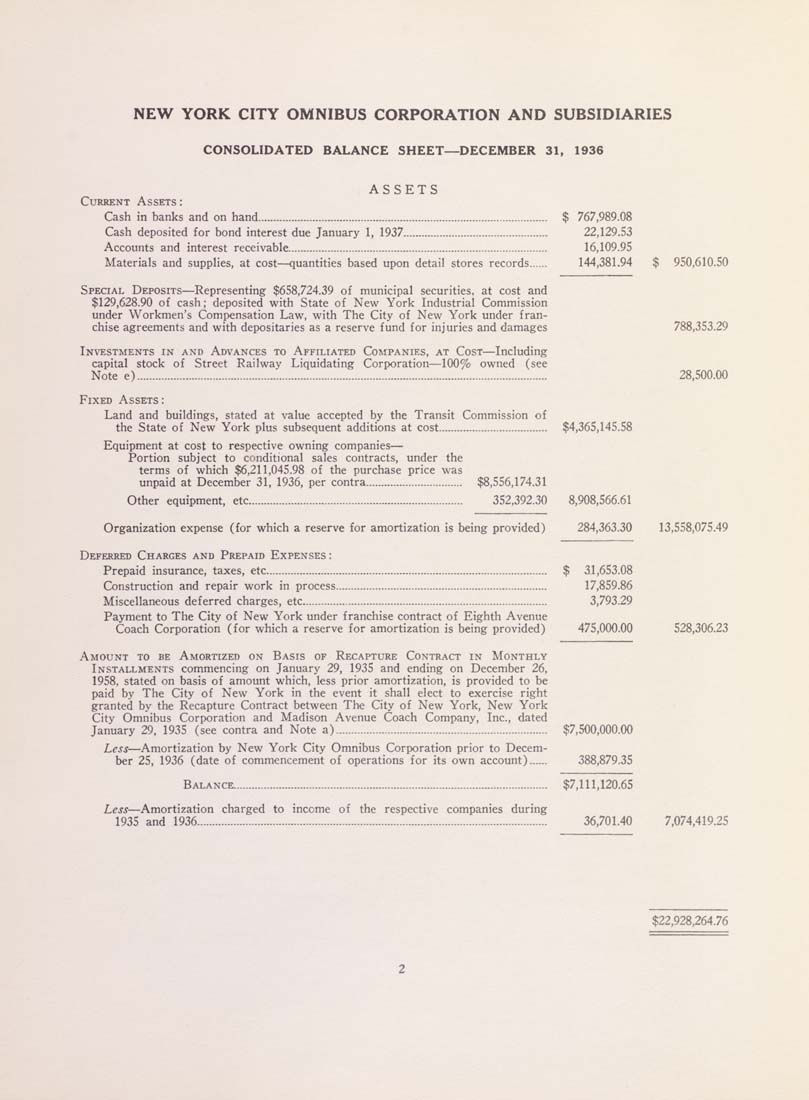

NEW YORK CITY OMNIBUS CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET—DECEMBER 31, 1936

ASSETS

Current Assets :

Cash in banks and on hand................................................................................................ $ 767,989.08

Cash deposited for bond interest due January 1, 1937................................................ 22,129.53

Accounts and interest receivable.............................................................-................____ 16,109.95

Materials and supplies, at cost—quantities based upon detail stores records...... 144,381.94 $ 950,610.50

Special Deposits—Representing $658,724.39 of municipal securities, at cost and

$129,628.90 of cash; deposited with State of New York Industrial Commission

under Workmen's Compensation Law, with The City of New York under fran¬

chise agreements and with depositaries as a reserve fund for injuries and damages

Investments in and Advances to Affiliated Companies, at Cost—Including

capital stock of Street Railway Liquidating Corporation—100% owned (see

Note e)........................................................................................................................................

Fixed Assets :

Land and buildings, stated at value accepted by the Transit Commission of

the State of New York plus subsequent additions at cost.................................... $4,365,145.58

Equipment at cost to respective owning companies—

Portion subject to conditional sales contracts, under the

terms of which $6,211,045.98 of the purchase price was

unpaid at December 31, 1936, per contra................................ $8,556,174.31

Other equipment, etc....................................................................... 352,392.30 8,908,566.61

Organization expense (for which a reserve for amortization is being provided) 284,363.30 13,558,075.49

Deferred Charges and Prepaid Expenses :

Prepaid insurance, taxes, etc............................................................................................. $ 31,653.08

Construction and repair work in process...................................................................... 17,859,86

Miscellaneous deferred charges, etc................................................................................. 3,793.29

Payment to The City of New York under franchise contract of Eighth Avenue

Coach Corporation (for which a reserve for amortization is being provided) 475,000.00

Amount to be Amortized on Basis of Recapture Contract in Monthly

Installments commencing on January 29, 1935 and ending on December 26,

1958, stated on basis of amount which, less prior amortization, is provided to be

paid by The City of New York in the event it shall elect to exercise right

granted by the Recapture Contract between The City of New York, New York

City Omnibus Corporation and Madison Avenue Coach Company, Inc., dated

January 29, 1935 (see contra and Note a)...................................................................... $7,500,000.00

Less—Amortization by New York City Omnibus Corporation prior to Decem¬

ber 25, 1936 (date of commencement of operations for its own account)...... 388,879.35

Balance........................................................................................................ $7,111,120.65

Less—Amortization charged to income of the respective companies during

1935 and 1936.................................................................................................................... 36,701.40 7,074,419.25

$22,928,264.76

|