New York City Omnibus Corporation

123 West 146th Street

New York, N. Y.

March 7, 1938

To the Stockholders of

New York City Omnibus Corporation:

This report to the stockholders includes the results of operation for New York City Omnibus Corporation

and its wholly owned subsidiaries, Madison Avenue Coach Company, Inc. and Eighth Avenue Coach Corporation,

for the year ended December 31, 1937, and also shows the financial condition of these companies.

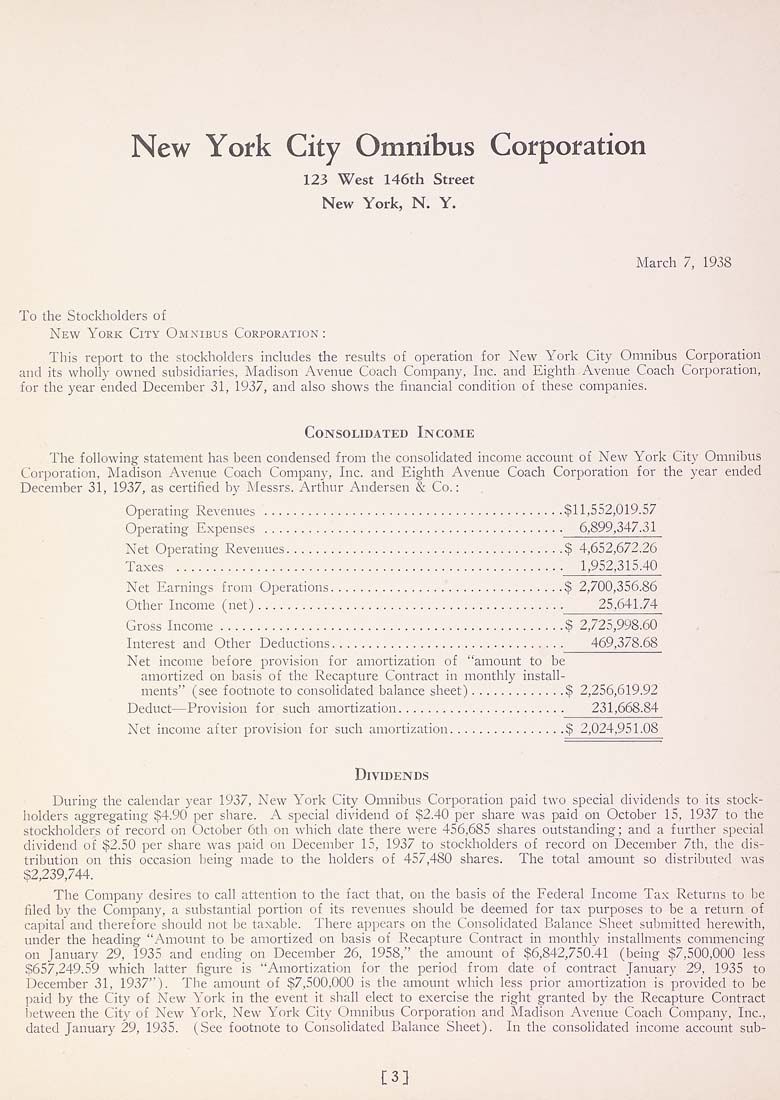

Consolidated Income

The following statement has been condensed from the consolidated income account of New York City Omnibus

Corporation, Madison Avenue Coach Company, Inc. and Eighth Avenue Coach Corporation for the year ended

December 31, 1937, as certified by Messrs. Arthur Andersen & Co.:

Operating Revenues .........................................$11,552,019.57

Operating Expenses ......................................... 6,899,347.31

Net Operating Revenues......................................$ 4,652,672.26

Taxes ..................................................... 1,952,315.40

Net Earnings from Operations................................? 2,700,356.86

Other Income (net).......................................... 25,641.74

Gross Income...............................................$ 2,725,998.60

Interest and Other Deductions............................... 469,378.68

Net income before provision for amortization of "amount to be

amortized on basis of the Recapture Contract in monthly install¬

ments" (see footnote to consolidated balance sheet).............% 2,256,619.92

Deduct—Provision for such amortization....................... 231,668.84

Net income after provision for such amortization................$ 2,024,951.08

Dividends

During the calendar year 1937, New York City Omnibus Corporation paid two special dividends to its stock¬

holders aggregating $4.90 per share. A special dividend of $2.40 per share was paid on October 15, 1937 to the

stockholders of record on October 6th on which date there were 456,685 shares outstanding; and a further special

dividend of $2.50 per share was paid on December 15, 1937 to stockholders of record on December 7th, the dis¬

tribution on this occasion being made to the holders of 457,480 shares. The total amount so distributed was

$2,239,744.

The Company desires to call attention to the fact that, on the basis of the Federal Income Tax Returns to be

filed by the Company, a substantial portion of its revenues should be deemed for tax purposes to be a return of

capital and therefore should not be taxable. There appears on the Consolidated Balance Sheet submitted herewith,

under the heading "Amount to be amortized on basis of Recapture Contract in monthly installments commencing

on January 29, 1935 and ending on December 26, 1958," the amount of $6,842,750.41 (being $7,500,000 less

$657,249.59 which latter figure is "Amortization for the period from date of contract January 29, 1935 to

December 31, 1937"). The amount of $7,500,000 is the amount which less prior amortization is provided to be

paid by the City of New York in the event it shall elect to exercise the right granted by the Recapture Contract

lietween the City of New York, New York City Omnibus Corporation and Madison Avenue Coach Company, Inc.,

dated January 29, 1935. (See footnote to Consolidated Balance Sheet). In the consolidated income account sub-

£3]

|