mitted herewith, this amount has been amortized upon the cumulative sinking fund basis specified in the Recapture

Contract, and this results in the $231,668.84 "provision for amortization." In its corporate Federal income tax

return for 1937, the Company will claim that its "tax cost base" should be computed upon the basis of the aggregate

cost of street railway property and franchises to predecessor companies, which will produce an amount substantially

in excess of $7,500,000, and also tliat it is entitled for tax purposes to amortize such "tax cost base" on a

straight line basis over the life of the bus franchise. This deduction to be claimed for purpose of Federal income

tax will therefore be much in excess of $231,668.84. The determination of the amount of this deduction will

involve difficult questions of fact and law and there will therefore be a considerable delay before the Treasury

Department has completed its audit and a final determination has been made. If the claims of the Company are

eventually sustained, a substantial portion of the distribution received by stockholders during 1937 may be free from

Federal taxes to such stockholders. Stockholders will be advised from time to time as to any rulings which may

be issued by the Treasury Department on the question of the extent to which the distributions made to stockholders

during 1937 shall be determined to be non-taxable.

Teaffic

The year 1937 was the first full calendar year during which omnibus operation was carried on upon all the

present routes of the corporation and its subsidiaries. It will be recalled that from time to time during the first

half of 1936 New York City Omnibus Corporation substituted omnibus operation upon the several routes on which

its predecessor company, New York Railways Corporation, had theretofore conducted street railway operation,

and also installed omnibus operation on four crosstown routes not formerly operated with street cars.

The total passenger revenues of New York City Omnibus Corporation, Madison Avenue Coach Company, Inc.

and Eighth Avenue Coach Corporation for the calendar year 1937 amounted to $11,501,410.89 representing an

increase of 2\y2% as compared with the total passenger revenues of the three companies during 1936 plus the

passenger revenues received by New York Railways Corporation from its street railway oj^eration.

The total number of passengers for all lines during 1937 including transfer passengers was 241,591,531.

Wage Agreement

On June 22, 1937 the employees of New York City Omnibus Corporation, Madison Avenue Coach Company,

Inc. and Eighth Avenue Coach Corporation, other than clerical and supervisory employees, held an election at

which the Transport Workers Union of America, affiliated with the Committee for Industrial Organization, was

selected as the bargaining agency to represent them in negotiations with the management with respect to wages and

working conditions.

Subsequent conferences with the Union officials resulted in an agreement for a closed shop and an increase in

the wage scale. The provisions of such contract are eitective until December 31, 1938.

Taxes

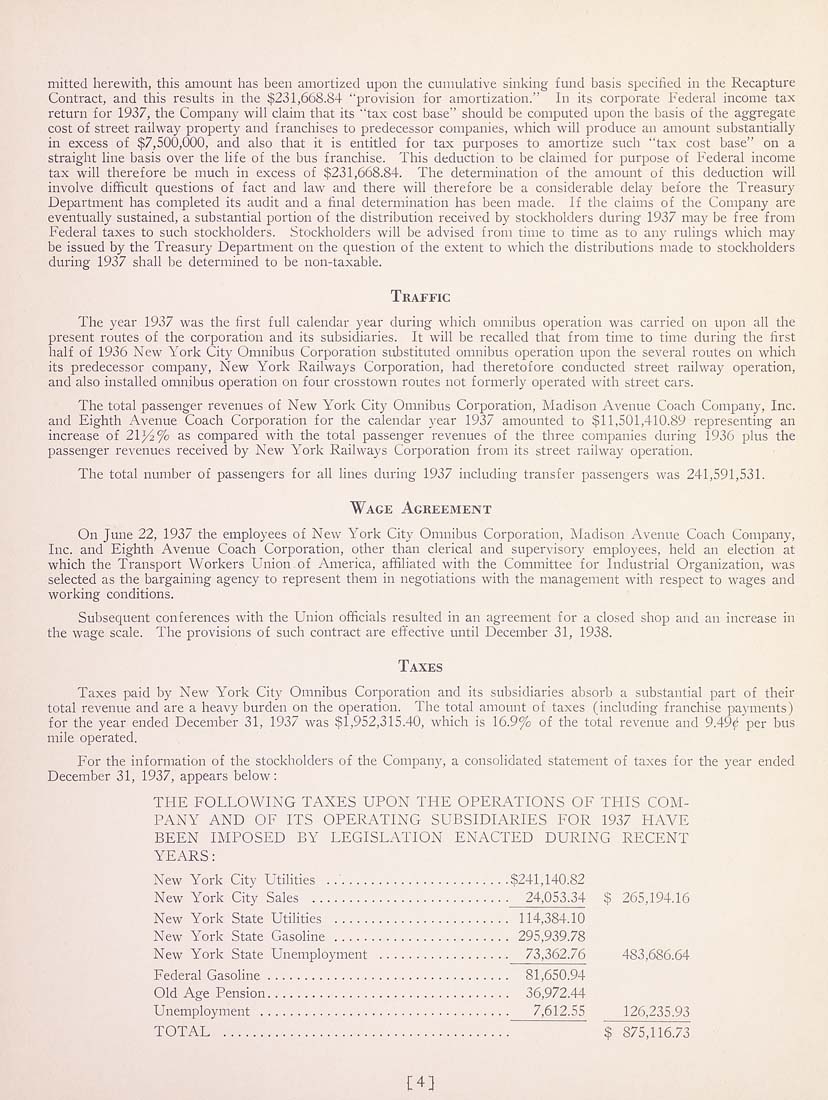

Taxes paid by New York City Omnibus Corporation and its subsidiaries absorb a substantial part of their

total revenue and are a heavy burden on the operation. The total amount of taxes (inchKling franchise payments)

for the year ended December 31, 1937 was $1,952,315.40, which is 16.9% of the total revenue and 9.49^; per bus

mile operated.

For the information of the stockholders of the Company, a consolidated statement of taxes for the year ended

December 31, 1937, appears below:

THE FOLLOWING TAXES UPON THE OPERATIONS OF TFHS COM¬

PANY AND OF ITS OPERATING SUBSIDIARIES FOR 1937 HAVE

BEEN IMPOSED BY LEGISLATION ENACTED DURING RECENT

YEARS:

New York City Utilities .........................$241,140.82

New York City Sales ........................... 24,053.34 $ 265,194.16

New York State Utilities ........................ 114,384.10

New York State Gasoline ........................ 295,939.78

New York State Unemployment .................. 73,362.76 483,686.64

Federal Gasoline................................. 81,650.94

Old Age Pension................................. 36,972.44

Unemployment .................................. 7,612.55 126,235.93

TOTAL ....................................... $ 875,116.73

1:4]

|